Summary

The success of large-scale models in recent years has increased the importance of statistical models with numerous parameters. Several studies have analyzed over-parameterized linear models with high-dimensional data that may not be sparse; however, existing results depend on the independent setting of samples. In this study, we analyze a linear regression model with dependent time series data under over-parameterization settings. We consider an estimator via interpolation and developed a theory for the excess risk of the estimator. Then, we derive bounds of risks by the estimator for the cases where the temporal correlation of each coordinate of dependent data is homogeneous and heterogeneous, respectively. The derived bounds reveal that a temporal covariance of the data plays a key role; its strength affects the bias of the risk, and its nondegeneracy affects the variance of the risk. Moreover, for the heterogeneous correlation case, we show that the convergence rate of risks with short-memory processes is identical to that of cases with independent data, and the risk can converge to zero even with long-memory processes. Our theory can be extended to infinite-dimensional data in a unified manner. We also present several examples of specific dependent processes that can be applied to our setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

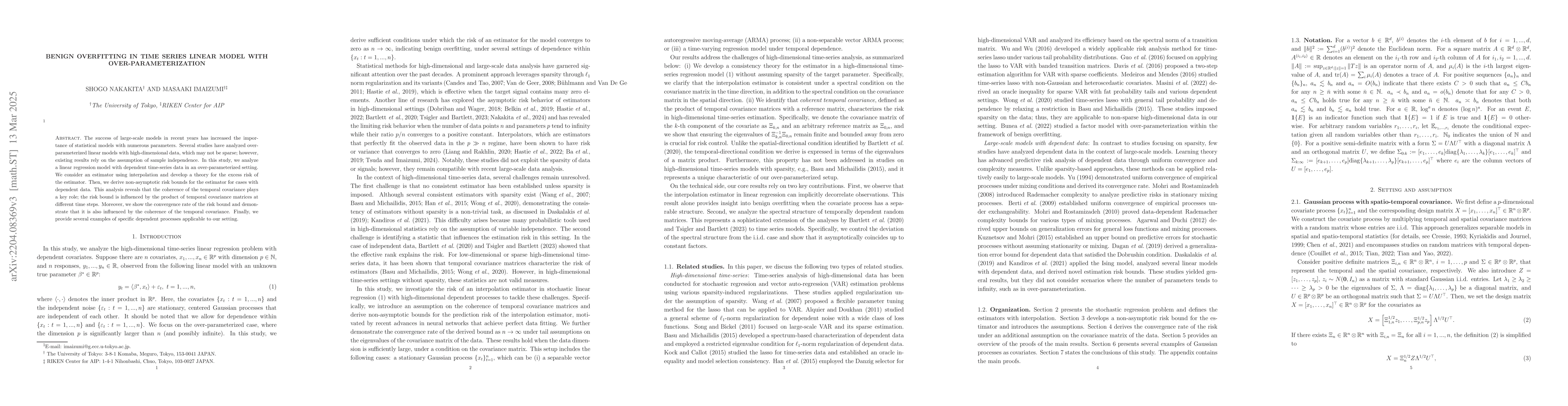

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenign Overfitting in Adversarially Robust Linear Classification

Jinghui Chen, Quanquan Gu, Yuan Cao

Benign Overfitting in Linear Regression

Peter L. Bartlett, Philip M. Long, Gábor Lugosi et al.

Universality of Benign Overfitting in Binary Linear Classification

Piotr Zwiernik, Stanislav Volgushev, Ichiro Hashimoto

| Title | Authors | Year | Actions |

|---|

Comments (0)