Summary

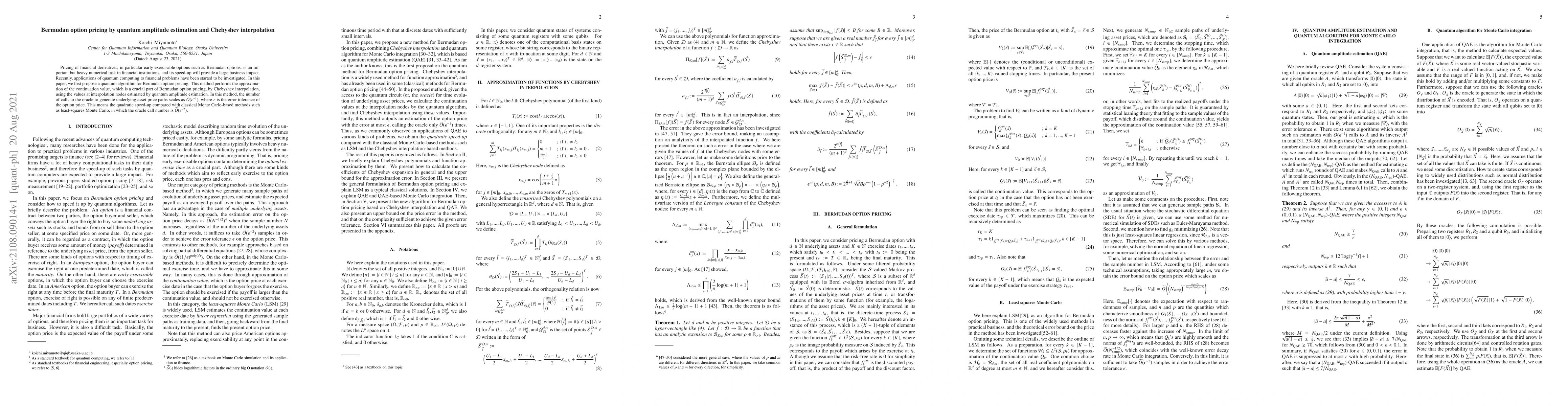

Pricing of financial derivatives, in particular early exercisable options such as Bermudan options, is an important but heavy numerical task in financial institutions, and its speed-up will provide a large business impact. Recently, applications of quantum computing to financial problems have been started to be investigated. In this paper, we first propose a quantum algorithm for Bermudan option pricing. This method performs the approximation of the continuation value, which is a crucial part of Bermudan option pricing, by Chebyshev interpolation, using the values at interpolation nodes estimated by quantum amplitude estimation. In this method, the number of calls to the oracle to generate underlying asset price paths scales as $\widetilde{O}(\epsilon^{-1})$, where $\epsilon$ is the error tolerance of the option price. This means the quadratic speed-up compared with classical Monte Carlo-based methods such as least-squares Monte Carlo, in which the oracle call number is $\widetilde{O}(\epsilon^{-2})$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Neural Networks for Bermudan Option Pricing: Convergence Acceleration, Future Exposure Evaluation and Interpolation in Counterparty Credit Risk

Vikranth Lokeshwar Dhandapani, Shashi Jain

| Title | Authors | Year | Actions |

|---|

Comments (0)