Authors

Summary

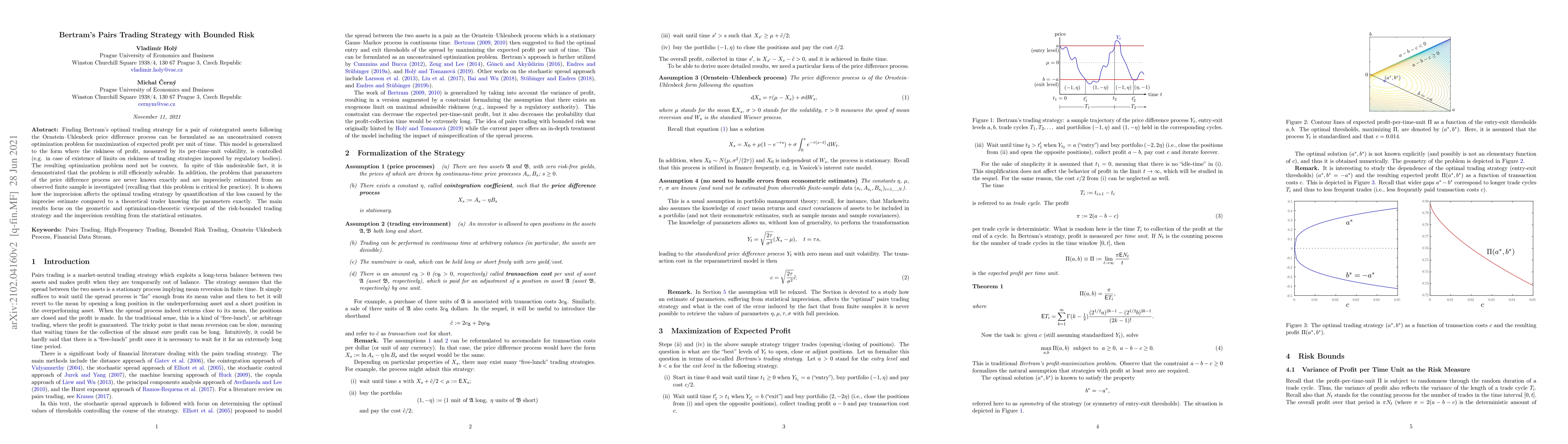

Finding Bertram's optimal trading strategy for a pair of cointegrated assets following the Ornstein--Uhlenbeck price difference process can be formulated as an unconstrained convex optimization problem for maximization of expected profit per unit of time. This model is generalized to the form where the riskiness of profit, measured by its per-time-unit volatility, is controlled (e.g. in case of existence of limits on riskiness of trading strategies imposed by regulatory bodies). The resulting optimization problem need not be convex. In spite of this undesirable fact, it is demonstrated that the problem is still efficiently solvable. In addition, the problem that parameters of the price difference process are never known exactly and are imprecisely estimated from an observed finite sample is investigated (recalling that this problem is critical for practice). It is shown how the imprecision affects the optimal trading strategy by quantification of the loss caused by the imprecise estimate compared to a theoretical trader knowing the parameters exactly. The main results focus on the geometric and optimization-theoretic viewpoint of the risk-bounded trading strategy and the imprecision resulting from the statistical estimates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCopula-Based Trading of Cointegrated Cryptocurrency Pairs

Masood Tadi, Jiří Witzany

Pairs Trading: An Optimal Selling Rule with Constraints

Qing Zhang, Zhen Wu, Ruyi Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)