Summary

We discuss risk measures representing the minimum amount of capital a financial institution needs to raise and invest in a pre-specified eligible asset to ensure it is adequately capitalized. Most of the literature has focused on cash-additive risk measures, for which the eligible asset is a risk-free bond, on the grounds that the general case can be reduced to the cash-additive case by a change of numeraire. However, discounting does not work in all financially relevant situations, typically when the eligible asset is a defaultable bond. In this paper we fill this gap allowing for general eligible assets. We provide a variety of finiteness and continuity results for the corresponding risk measures and apply them to risk measures based on Value-at-Risk and Tail Value-at-Risk on $L^p$ spaces, as well as to shortfall risk measures on Orlicz spaces. We pay special attention to the property of cash subadditivity, which has been recently proposed as an alternative to cash additivity to deal with defaultable bonds. For important examples, we provide characterizations of cash subadditivity and show that, when the eligible asset is a defaultable bond, cash subadditivity is the exception rather than the rule. Finally, we consider the situation where the eligible asset is not liquidly traded and the pricing rule is no longer linear. We establish when the resulting risk measures are quasiconvex and show that cash subadditivity is only compatible with continuous pricing rules.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

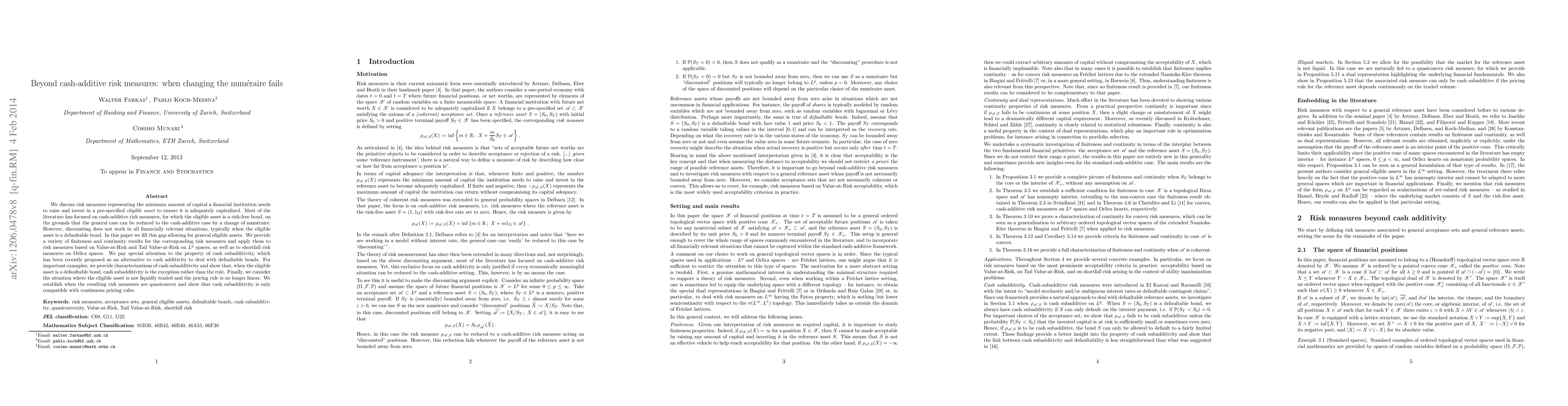

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCash non-additive risk measures: horizon risk and generalized entropy

Giulia Di Nunno, Emanuela Rosazza Gianin

Cash-subadditive risk measures without quasi-convexity

Xia Han, Ruodu Wang, Qiuqi Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)