Authors

Summary

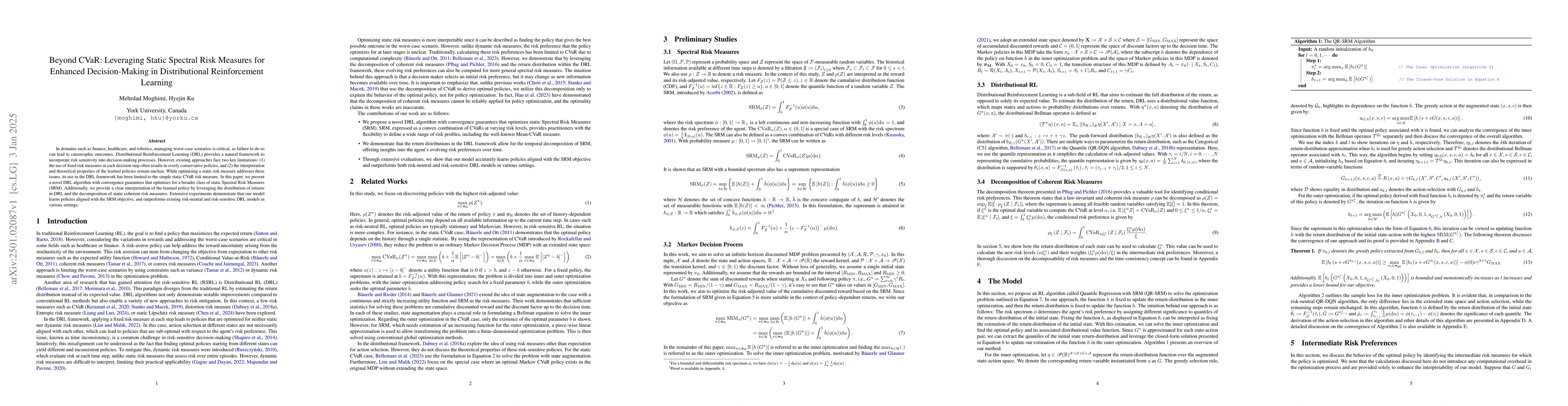

In domains such as finance, healthcare, and robotics, managing worst-case scenarios is critical, as failure to do so can lead to catastrophic outcomes. Distributional Reinforcement Learning (DRL) provides a natural framework to incorporate risk sensitivity into decision-making processes. However, existing approaches face two key limitations: (1) the use of fixed risk measures at each decision step often results in overly conservative policies, and (2) the interpretation and theoretical properties of the learned policies remain unclear. While optimizing a static risk measure addresses these issues, its use in the DRL framework has been limited to the simple static CVaR risk measure. In this paper, we present a novel DRL algorithm with convergence guarantees that optimizes for a broader class of static Spectral Risk Measures (SRM). Additionally, we provide a clear interpretation of the learned policy by leveraging the distribution of returns in DRL and the decomposition of static coherent risk measures. Extensive experiments demonstrate that our model learns policies aligned with the SRM objective, and outperforms existing risk-neutral and risk-sensitive DRL models in various settings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-sensitive Actor-Critic with Static Spectral Risk Measures for Online and Offline Reinforcement Learning

Hyejin Ku, Mehrdad Moghimi

On Dynamic Programming Decompositions of Static Risk Measures in Markov Decision Processes

Marek Petrik, Jia Lin Hau, Erick Delage et al.

Provable Risk-Sensitive Distributional Reinforcement Learning with General Function Approximation

Yu Chen, Siwei Wang, Longbo Huang et al.

No citations found for this paper.

Comments (0)