Authors

Summary

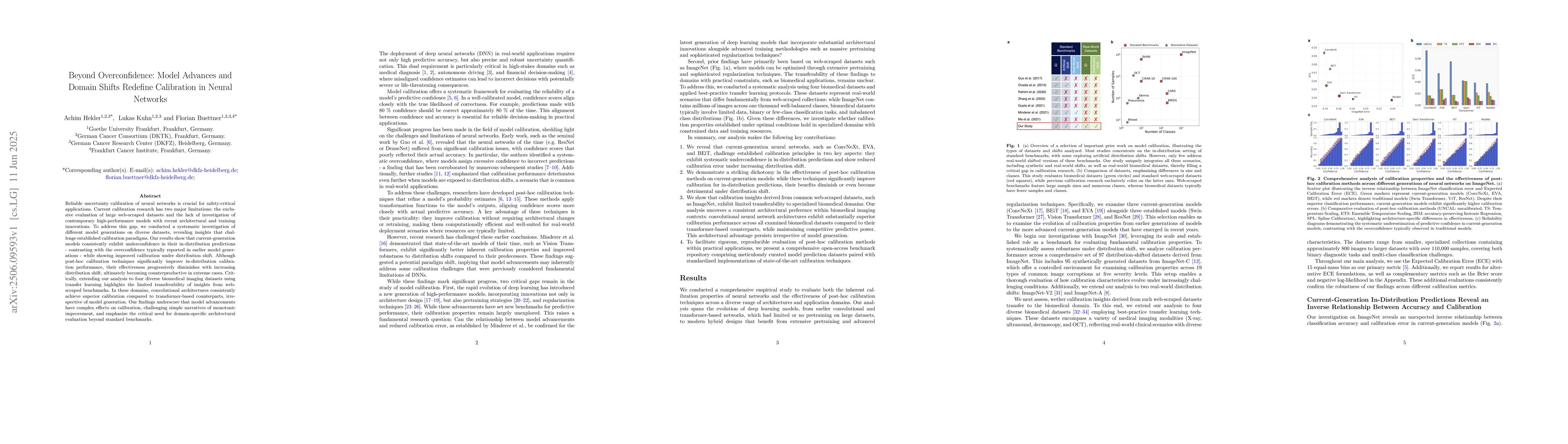

Reliable uncertainty calibration is essential for safely deploying deep neural networks in high-stakes applications. Deep neural networks are known to exhibit systematic overconfidence, especially under distribution shifts. Although foundation models such as ConvNeXt, EVA and BEiT have demonstrated significant improvements in predictive performance, their calibration properties remain underexplored. This paper presents a comprehensive investigation into the calibration behavior of foundation models, revealing insights that challenge established paradigms. Our empirical analysis shows that these models tend to be underconfident in in-distribution predictions, resulting in higher calibration errors, while demonstrating improved calibration under distribution shifts. Furthermore, we demonstrate that foundation models are highly responsive to post-hoc calibration techniques in the in-distribution setting, enabling practitioners to effectively mitigate underconfidence bias. However, these methods become progressively less reliable under severe distribution shifts and can occasionally produce counterproductive results. Our findings highlight the complex, non-monotonic effects of architectural and training innovations on calibration, challenging established narratives of continuous improvement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFixing Overconfidence in Dynamic Neural Networks

Arno Solin, Le Yang, Martin Trapp et al.

No citations found for this paper.

Comments (0)