Summary

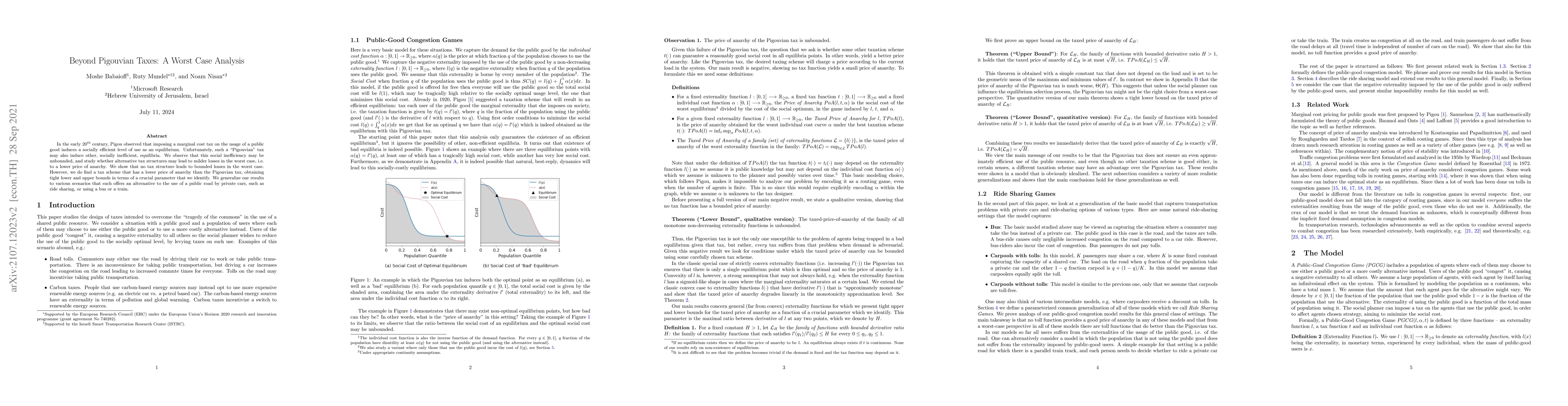

In the early $20^{th}$ century, Pigou observed that imposing a marginal cost tax on the usage of a public good induces a socially efficient level of use as an equilibrium. Unfortunately, such a "Pigouvian" tax may also induce other, socially inefficient, equilibria. We observe that this social inefficiency may be unbounded, and study whether alternative tax structures may lead to milder losses in the worst case, i.e. to a lower price of anarchy. We show that no tax structure leads to bounded losses in the worst case. However, we do find a tax scheme that has a lower price of anarchy than the Pigouvian tax, obtaining tight lower and upper bounds in terms of a crucial parameter that we identify. We generalize our results to various scenarios that each offers an alternative to the use of a public road by private cars, such as ride sharing, or using a bus or a train.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)