Authors

Summary

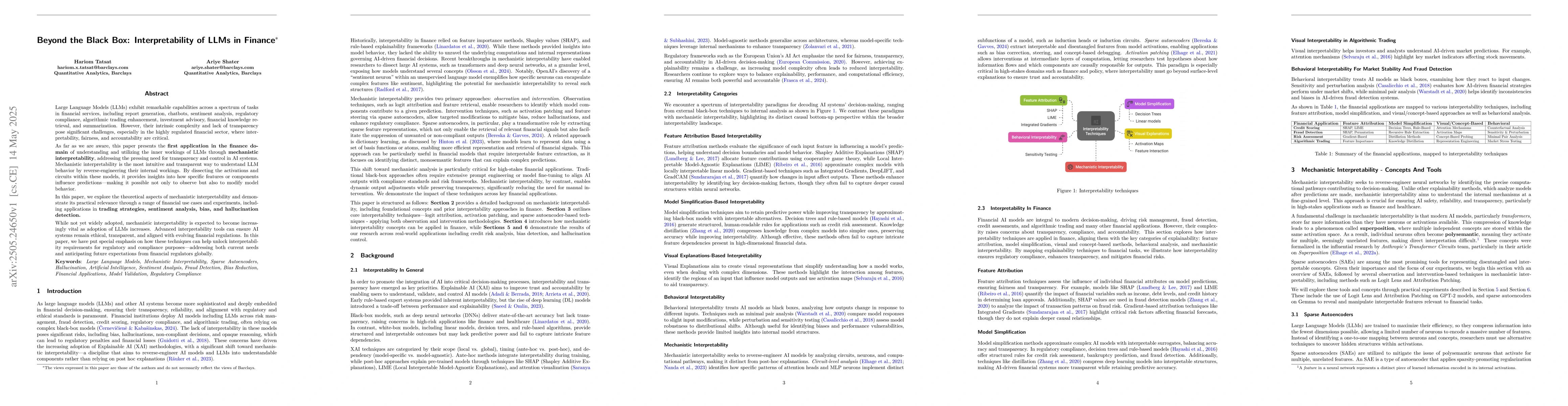

Large Language Models (LLMs) exhibit remarkable capabilities across a spectrum of tasks in financial services, including report generation, chatbots, sentiment analysis, regulatory compliance, investment advisory, financial knowledge retrieval, and summarization. However, their intrinsic complexity and lack of transparency pose significant challenges, especially in the highly regulated financial sector, where interpretability, fairness, and accountability are critical. As far as we are aware, this paper presents the first application in the finance domain of understanding and utilizing the inner workings of LLMs through mechanistic interpretability, addressing the pressing need for transparency and control in AI systems. Mechanistic interpretability is the most intuitive and transparent way to understand LLM behavior by reverse-engineering their internal workings. By dissecting the activations and circuits within these models, it provides insights into how specific features or components influence predictions - making it possible not only to observe but also to modify model behavior. In this paper, we explore the theoretical aspects of mechanistic interpretability and demonstrate its practical relevance through a range of financial use cases and experiments, including applications in trading strategies, sentiment analysis, bias, and hallucination detection. While not yet widely adopted, mechanistic interpretability is expected to become increasingly vital as adoption of LLMs increases. Advanced interpretability tools can ensure AI systems remain ethical, transparent, and aligned with evolving financial regulations. In this paper, we have put special emphasis on how these techniques can help unlock interpretability requirements for regulatory and compliance purposes - addressing both current needs and anticipating future expectations from financial regulators globally.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper explores the theoretical aspects of mechanistic interpretability and demonstrates its practical relevance through financial use cases and experiments, including trading strategies, sentiment analysis, bias, and hallucination detection.

Key Results

- Mechanistic interpretability provides insights into LLM behavior by reverse-engineering their internal workings, enabling observation and modification of model behavior.

- The approach is applicable to various financial tasks such as report generation, chatbots, sentiment analysis, regulatory compliance, investment advisory, financial knowledge retrieval, and summarization.

- The paper highlights the potential of mechanistic interpretability to ensure AI systems remain ethical, transparent, and aligned with financial regulations.

Significance

This research is crucial for the finance domain as it addresses the pressing need for transparency and control in AI systems, especially where interpretability, fairness, and accountability are critical.

Technical Contribution

The paper presents the application of mechanistic interpretability to understand and utilize the inner workings of LLMs in finance, providing a transparent way to observe and modify model behavior.

Novelty

This work is novel as it is the first to apply mechanistic interpretability in the finance domain, addressing the unique challenges of transparency, fairness, and accountability in AI systems within financial services.

Limitations

- Mechanistic interpretability is not yet widely adopted.

- The approach might require significant expertise and resources for implementation.

Future Work

- Further research could focus on refining and optimizing mechanistic interpretability techniques for broader applicability.

- Investigating integration of mechanistic interpretability with existing LLM frameworks and tools.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMatryoshka: Learning to Drive Black-Box LLMs with LLMs

Chao Zhang, Bo Dai, Haotian Sun et al.

Gnothi Seauton: Empowering Faithful Self-Interpretability in Black-Box Models

Xuming Hu, Mingyang Wang, Linfeng Zhang et al.

A Survey of Calibration Process for Black-Box LLMs

Jing Huang, Suhang Wang, Chen Luo et al.

No citations found for this paper.

Comments (0)