Authors

Summary

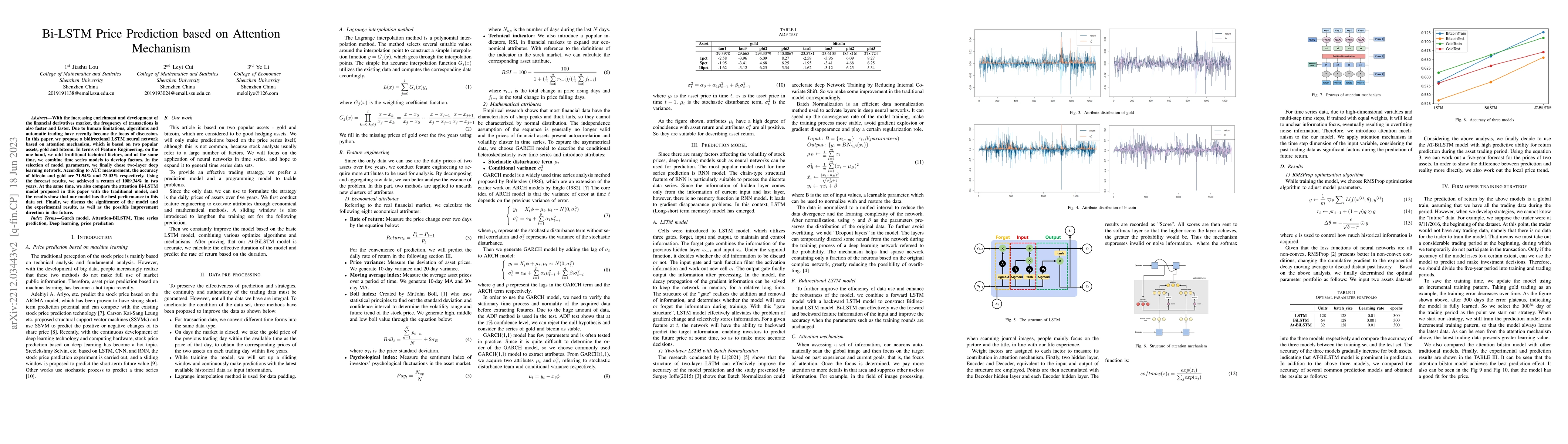

With the increasing enrichment and development of the financial derivatives market, the frequency of transactions is also faster and faster. Due to human limitations, algorithms and automatic trading have recently become the focus of discussion. In this paper, we propose a bidirectional LSTM neural network based on an attention mechanism, which is based on two popular assets, gold and bitcoin. In terms of Feature Engineering, on the one hand, we add traditional technical factors, and at the same time, we combine time series models to develop factors. In the selection of model parameters, we finally chose a two-layer deep learning network. According to AUC measurement, the accuracy of bitcoin and gold is 71.94% and 73.03% respectively. Using the forecast results, we achieved a return of 1089.34% in two years. At the same time, we also compare the attention Bi-LSTM model proposed in this paper with the traditional model, and the results show that our model has the best performance in this data set. Finally, we discuss the significance of the model and the experimental results, as well as the possible improvement direction in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Market Price Prediction: A Hybrid LSTM and Sequential Self-Attention based Approach

Ahmed M. Abdelmoniem, Sukhpal Singh Gill, Karan Pardeshi

Human trajectory prediction using LSTM with Attention mechanism

Amin Manafi Soltan Ahmadi, Samaneh Hoseini Semnani

| Title | Authors | Year | Actions |

|---|

Comments (0)