Summary

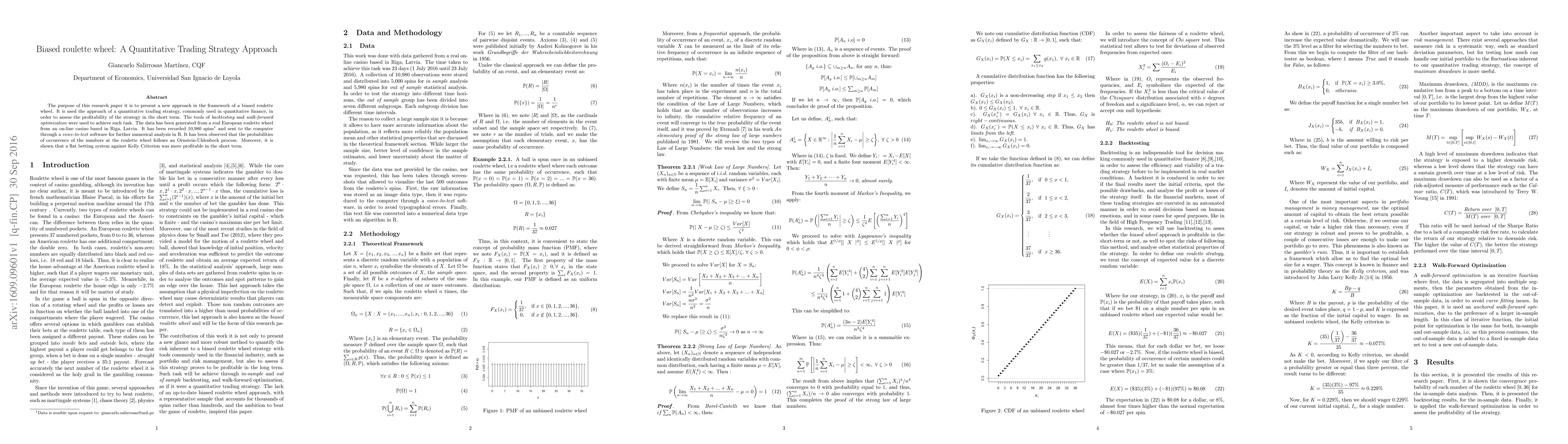

The purpose of this research paper it is to present a new approach in the framework of a biased roulette wheel. It is used the approach of a quantitative trading strategy, commonly used in quantitative finance, in order to assess the profitability of the strategy in the short term. The tools of backtesting and walk-forward optimization were used to achieve such task. The data has been generated from a real European roulette wheel from an on-line casino based in Riga, Latvia. It has been recorded 10,980 spins and sent to the computer through a voice-to-text software for further numerical analysis in R. It has been observed that the probabilities of occurrence of the numbers at the roulette wheel follows an Ornstein-Uhlenbeck process. Moreover, it is shown that a flat betting system against Kelly Criterion was more profitable in the short term.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)