Summary

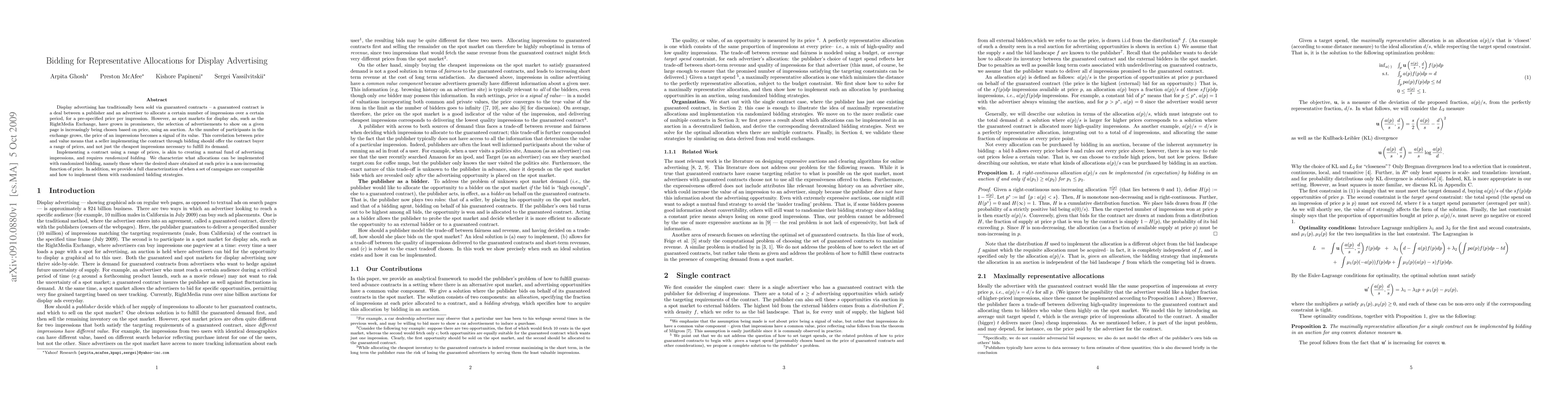

Display advertising has traditionally been sold via guaranteed contracts -- a guaranteed contract is a deal between a publisher and an advertiser to allocate a certain number of impressions over a certain period, for a pre-specified price per impression. However, as spot markets for display ads, such as the RightMedia Exchange, have grown in prominence, the selection of advertisements to show on a given page is increasingly being chosen based on price, using an auction. As the number of participants in the exchange grows, the price of an impressions becomes a signal of its value. This correlation between price and value means that a seller implementing the contract through bidding should offer the contract buyer a range of prices, and not just the cheapest impressions necessary to fulfill its demand. Implementing a contract using a range of prices, is akin to creating a mutual fund of advertising impressions, and requires {\em randomized bidding}. We characterize what allocations can be implemented with randomized bidding, namely those where the desired share obtained at each price is a non-increasing function of price. In addition, we provide a full characterization of when a set of campaigns are compatible and how to implement them with randomized bidding strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReal-time Bidding Strategy in Display Advertising: An Empirical Analysis

Zhengning Hu, Mengjuan Liu, Zhi Lai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)