Summary

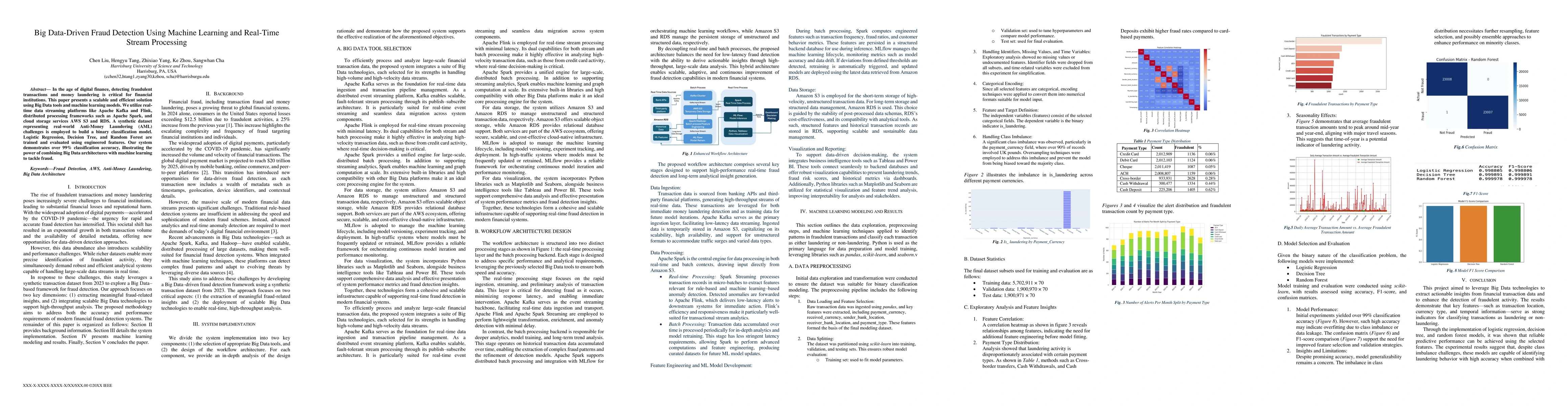

In the age of digital finance, detecting fraudulent transactions and money laundering is critical for financial institutions. This paper presents a scalable and efficient solution using Big Data tools and machine learning models. We utilize realtime data streaming platforms like Apache Kafka and Flink, distributed processing frameworks such as Apache Spark, and cloud storage services AWS S3 and RDS. A synthetic dataset representing real-world Anti-Money Laundering (AML) challenges is employed to build a binary classification model. Logistic Regression, Decision Tree, and Random Forest are trained and evaluated using engineered features. Our system demonstrates over 99% classification accuracy, illustrating the power of combining Big Data architectures with machine learning to tackle fraud.

AI Key Findings

Generated Sep 05, 2025

Methodology

A Big Data-driven approach using Apache Kafka, Flink, Spark, AWS S3, RDS, and MLflow for real-time fraud detection

Key Results

- Achieved over 99% classification accuracy with logistic regression, decision tree, and random forest models

- Identified key features such as transaction location, currency type, and temporal information for laundering behavior

- Developed a scalable and efficient system for processing high-volume transaction data

Significance

This research highlights the potential of Big Data technologies in detecting and mitigating fraudulent transactions more efficiently and at scale

Technical Contribution

The development of a scalable and efficient Big Data-driven approach for real-time fraud detection using Apache Kafka, Flink, Spark, AWS S3, RDS, and MLflow

Novelty

This work leverages Big Data technologies to extract actionable insights from financial transaction data and enhance the detection of fraudulent activity

Limitations

- Class imbalance challenges necessitate further resampling, feature selection, and ensemble approaches to enhance performance on minority classes

- Potential for overfitting due to class imbalance or data leakage

Future Work

- Incorporating temporal features and ensemble learning techniques for enhanced generalization and operational robustness

- Exploring real-world deployment scenarios for the proposed system

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFraud Analytics Using Machine-learning & Engineering on Big Data (FAME) for Telecom

Sudarson Roy Pratihar, Subhadip Paul, Pranab Kumar Dash et al.

No citations found for this paper.

Comments (0)