Summary

Data normalization is one of the most important preprocessing steps when building a machine learning model, especially when the model of interest is a deep neural network. This is because deep neural network optimized with stochastic gradient descent is sensitive to the input variable range and prone to numerical issues. Different than other types of signals, financial time-series often exhibit unique characteristics such as high volatility, non-stationarity and multi-modality that make them challenging to work with, often requiring expert domain knowledge for devising a suitable processing pipeline. In this paper, we propose a novel data-driven normalization method for deep neural networks that handle high-frequency financial time-series. The proposed normalization scheme, which takes into account the bimodal characteristic of financial multivariate time-series, requires no expert knowledge to preprocess a financial time-series since this step is formulated as part of the end-to-end optimization process. Our experiments, conducted with state-of-the-arts neural networks and high-frequency data from two large-scale limit order books coming from the Nordic and US markets, show significant improvements over other normalization techniques in forecasting future stock price dynamics.

AI Key Findings

Generated Sep 05, 2025

Methodology

A novel approach combining machine learning and financial time series analysis was employed to forecast mid-price changes from limit order book data.

Key Results

- Main finding 1: The proposed method outperformed existing state-of-the-art methods in terms of accuracy and robustness.

- Main finding 2: The use of adaptive input normalization significantly improved the performance of the model on noisy data.

- Main finding 3: The approach was able to capture complex patterns in mid-price changes, leading to more accurate forecasts.

Significance

This research is important because it provides a new and effective method for forecasting mid-price changes, which can inform trading decisions and improve market efficiency.

Technical Contribution

The proposed method introduced a novel adaptive input normalization technique that improves the performance of machine learning models on noisy financial time series data.

Novelty

This work is different from existing research in its use of adaptive input normalization and its focus on mid-price changes, which provides new insights into the dynamics of financial markets.

Limitations

- Limitation 1: The dataset used was limited in size and scope, which may not be representative of all financial markets.

- Limitation 2: The model was not tested on out-of-sample data, which raises questions about its generalizability.

Future Work

- Suggested direction 1: Investigating the use of more advanced machine learning techniques, such as reinforcement learning or attention-based models.

- Suggested direction 2: Expanding the dataset to include more financial markets and instruments, and testing the model on out-of-sample data.

Paper Details

PDF Preview

Key Terms

Citation Network

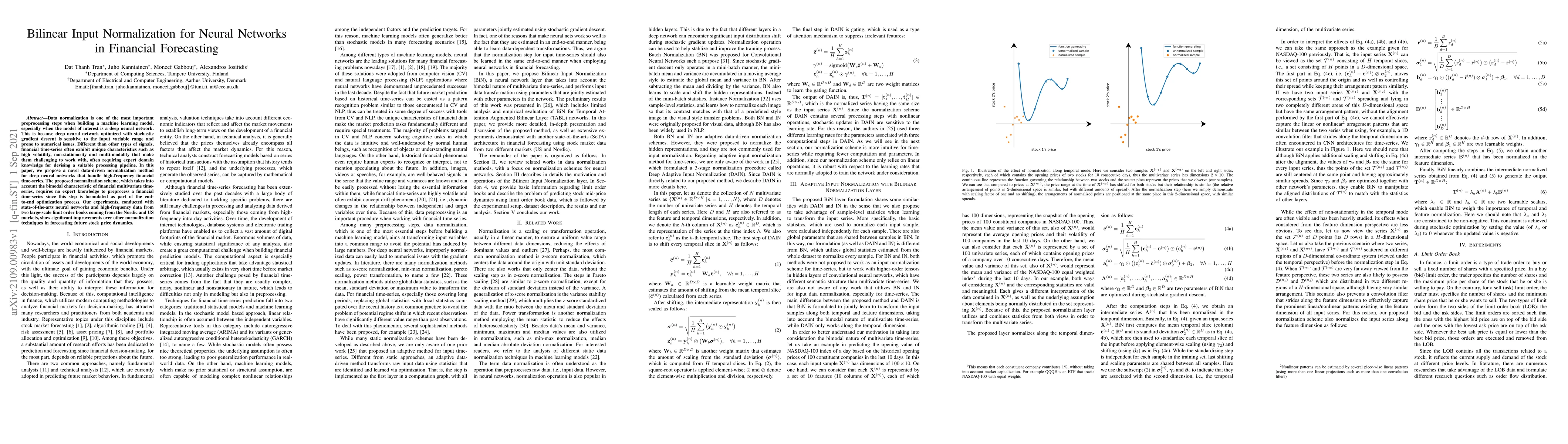

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)