Summary

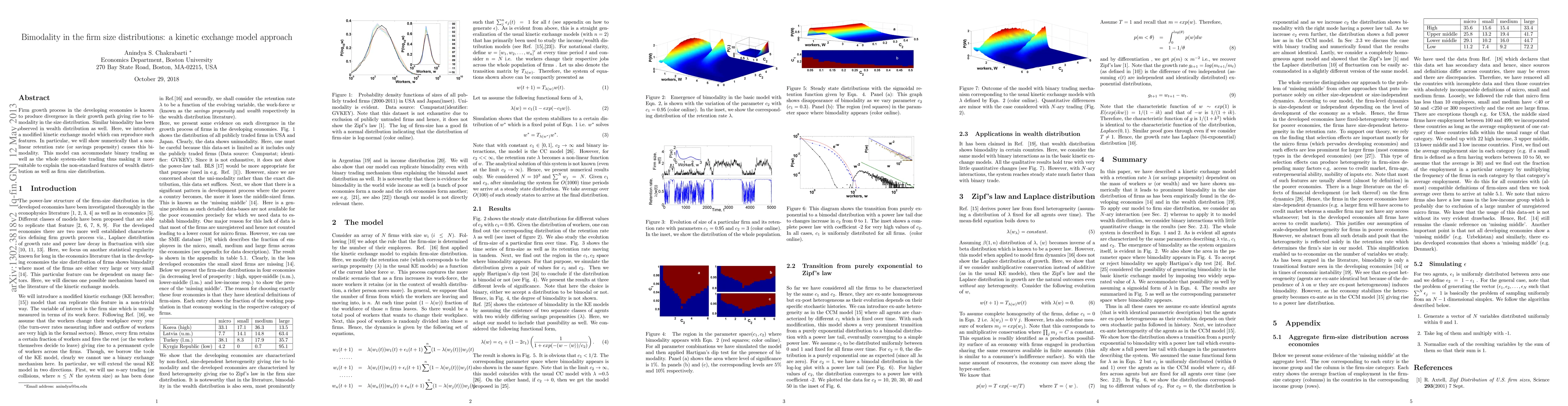

Firm growth process in the developing economies is known to produce divergence in their growth path giving rise to bimodality in the size distribution. Similar bimodality has been observed in wealth distribution as well. Here, we introduce a modified kinetic exchange model which can reproduce such features. In particular, we will show numerically that a nonlinear retention rate (or savings propensity) causes this bimodality. This model can accommodate binary trading as well as the whole system-side trading thus making it more suitable to explain the non-standard features of wealth distribution as well as firm size distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA kinetic description of the body size distributions of species

Eleonora Vercesi, Stefano Gualandi, Giuseppe Toscani

No citations found for this paper.

Comments (0)