Summary

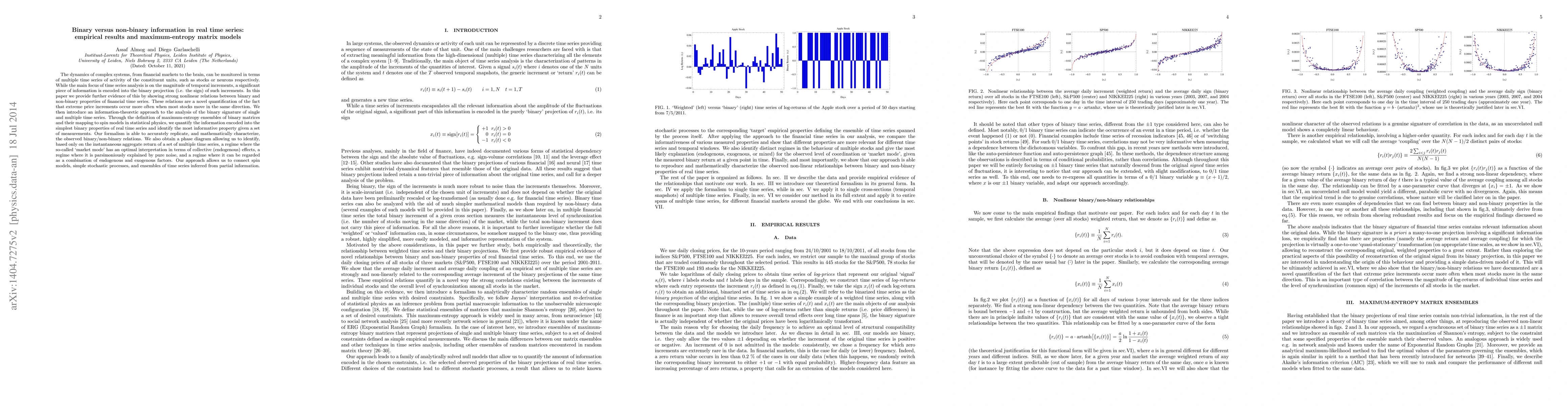

The dynamics of complex systems, from financial markets to the brain, can be monitored in terms of multiple time series of activity of the constituent units, such as stocks or neurons respectively. While the main focus of time series analysis is on the magnitude of temporal increments, a significant piece of information is encoded into the binary projection (i.e. the sign) of such increments. In this paper we provide further evidence of this by showing strong nonlinear relations between binary and non-binary properties of financial time series. These relations are a novel quantification of the fact that extreme price increments occur more often when most stocks move in the same direction. We then introduce an information-theoretic approach to the analysis of the binary signature of single and multiple time series. Through the definition of maximum-entropy ensembles of binary matrices and their mapping to spin models in statistical physics, we quantify the information encoded into the simplest binary properties of real time series and identify the most informative property given a set of measurements. Our formalism is able to accurately replicate, and mathematically characterize, the observed binary/non-binary relations. We also obtain a phase diagram allowing us to identify, based only on the instantaneous aggregate return of a set of multiple time series, a regime where the so-called `market mode' has an optimal interpretation in terms of collective (endogenous) effects, a regime where it is parsimoniously explained by pure noise, and a regime where it can be regarded as a combination of endogenous and exogenous factors. Our approach allows us to connect spin models, simple stochastic processes, and ensembles of time series inferred from partial information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenign overfitting in leaky ReLU networks with moderate input dimension

Deanna Needell, Kedar Karhadkar, Michael Murray et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)