Authors

Summary

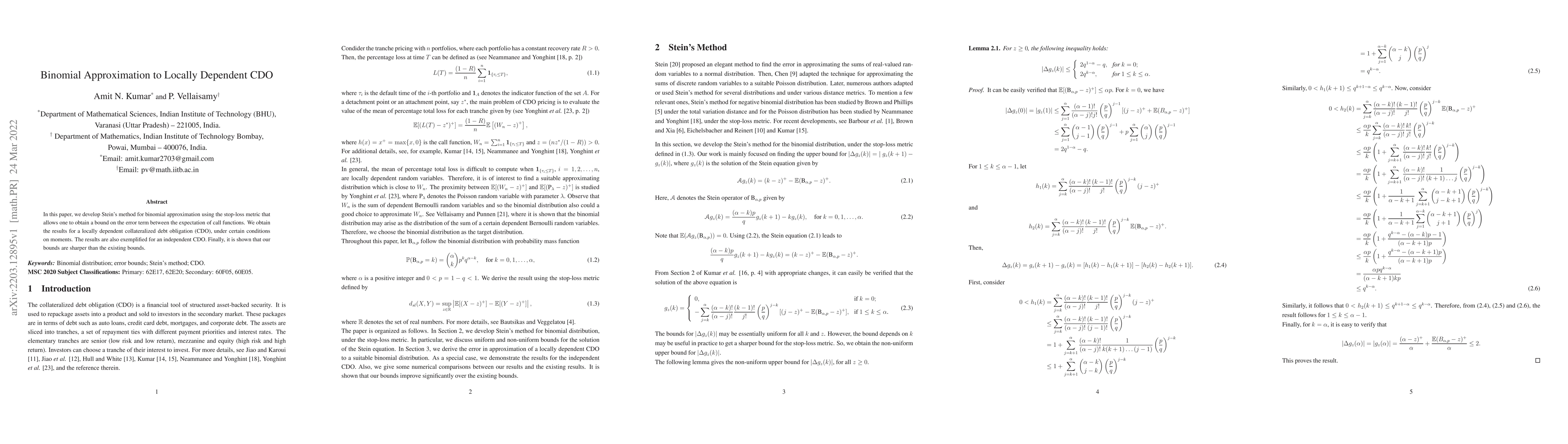

In this paper, we develop Stein's method for binomial approximation using the stop-loss metric that allows one to obtain a bound on the error term between the expectation of call functions. We obtain the results for a locally dependent collateralized debt obligation (CDO), under certain conditions on moments. The results are also exemplified for an independent CDO. Finally, it is shown that our bounds are sharper than the existing bounds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)