Summary

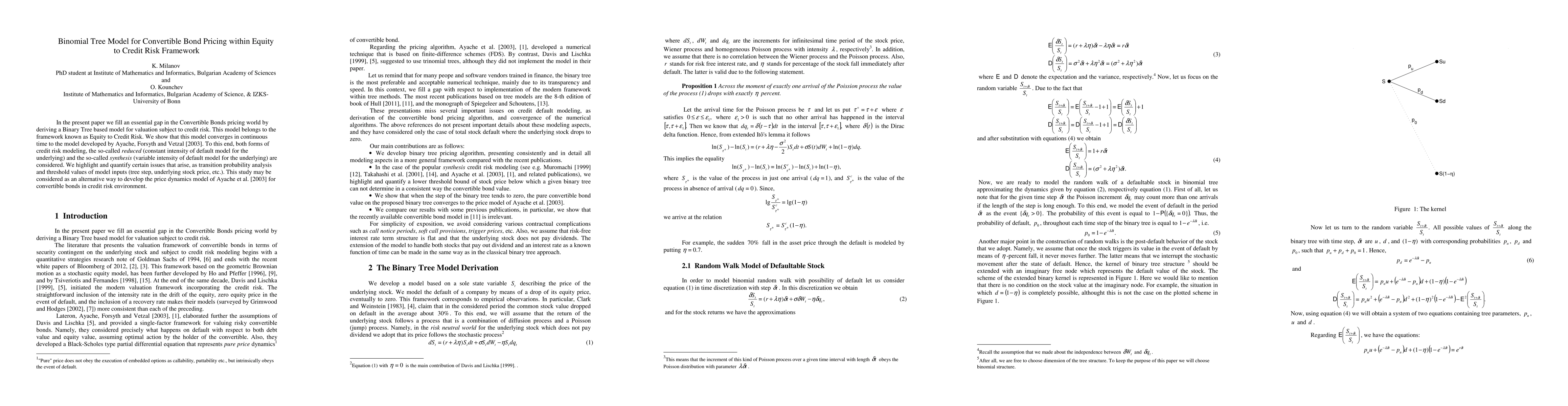

In the present paper we fill an essential gap in the Convertible Bonds pricing world by deriving a Binary Tree based model for valuation subject to credit risk. This model belongs to the framework known as Equity to Credit Risk. We show that this model converges in continuous time to the model developed by Ayache, Forsyth and Vetzal [2003]. To this end, both forms of credit risk modeling, the so-called reduced (constant intensity of default model for the underlying) and the so-called synthesis (variable intensity of default model for the underlying) are considered. We highlight and quantify certain issues that arise, as transition probability analysis and threshold values of model inputs (tree step, underlying stock price, etc.). This study may be considered as an alternative way to develop the price dynamics model of Ayache et al. [2003] for convertible bonds in credit risk environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)