Summary

The question "what is Bitcoin" allows for many answers depending on the objectives aimed at when providing such answers. The question addressed in this paper is to determine a top-level classification, or type, for Bitcoin. We will classify Bitcoin as a system of type money-like informational commodity (MLIC).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

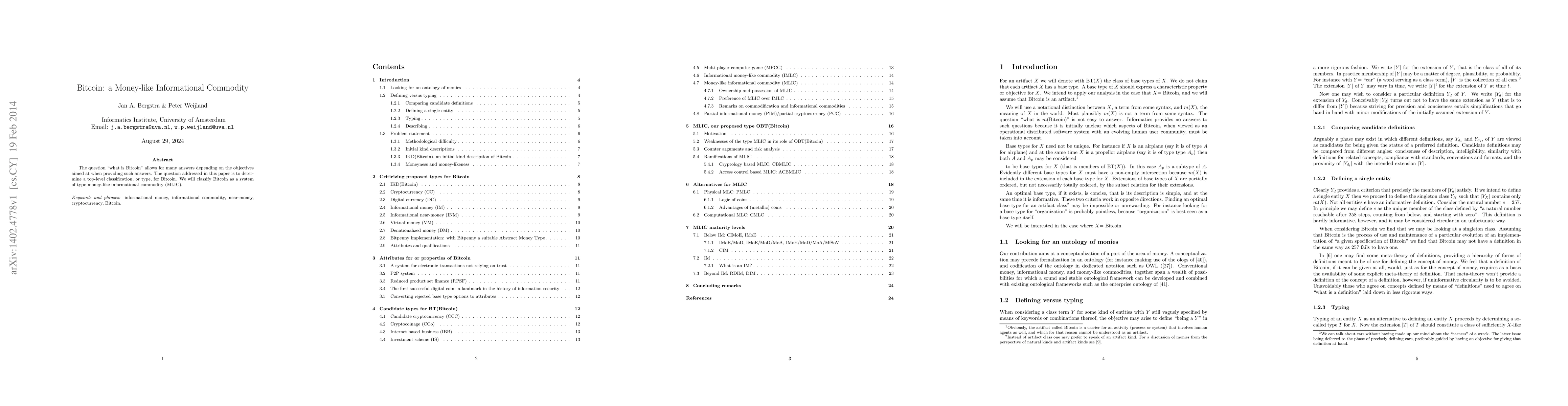

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGreen Bitcoin: Global Sound Money

Young-Sik Kim, Manjit Kaur, Heung-No Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)