Summary

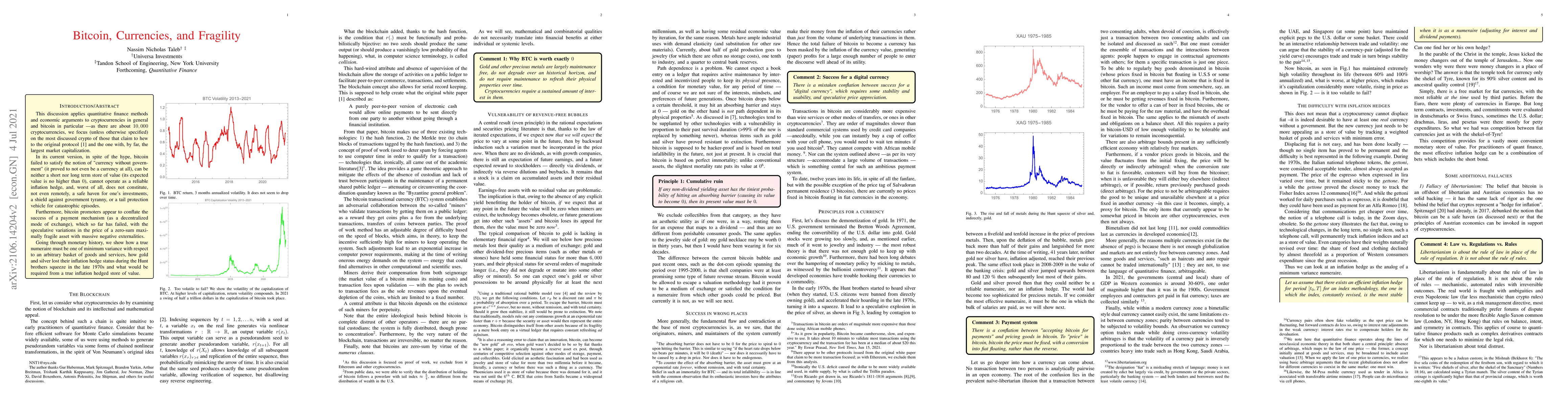

This discussion applies quantitative finance methods and economic arguments to cryptocurrencies in general and bitcoin in particular -- as there are about $10,000$ cryptocurrencies, we focus (unless otherwise specified) on the most discussed crypto of those that claim to hew to the original protocol (Nakamoto 2009) and the one with, by far, the largest market capitalization. In its current version, in spite of the hype, bitcoin failed to satisfy the notion of "currency without government" (it proved to not even be a currency at all), can be neither a short nor long term store of value (its expected value is no higher than $0$), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a safe haven for one's investments, a shield against government tyranny, or a tail protection vehicle for catastrophic episodes. Furthermore, bitcoin promoters appear to conflate the success of a payment mechanism (as a decentralized mode of exchange), which so far has failed, with the speculative variations in the price of a zero-sum maximally fragile asset with massive negative externalities. Going through monetary history, we show how a true numeraire must be one of minimum variance with respect to an arbitrary basket of goods and services, how gold and silver lost their inflation hedge status during the Hunt brothers squeeze in the late 1970s and what would be required from a true inflation hedged store of value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)