Authors

Summary

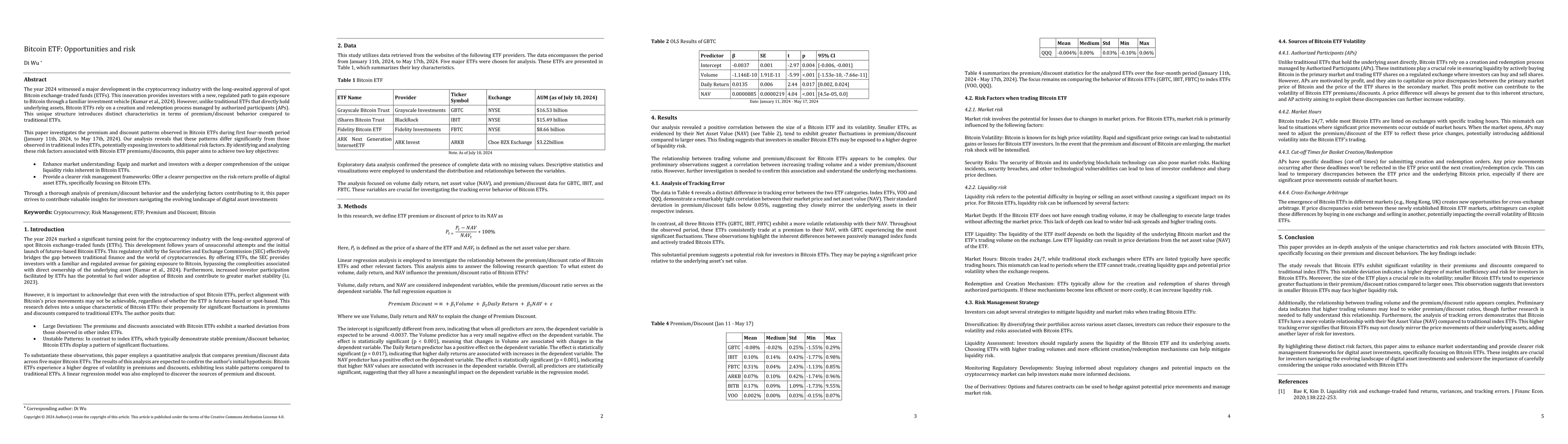

The year 2024 witnessed a major development in the cryptocurrency industry with the long-awaited approval of spot Bitcoin exchange-traded funds (ETFs). This innovation provides investors with a new, regulated path to gain exposure to Bitcoin through a familiar investment vehicle (Kumar et al., 2024). However, unlike traditional ETFs that directly hold underlying assets, Bitcoin ETFs rely on a creation and redemption process managed by authorized participants (APs). This unique structure introduces distinct characteristics in terms of premium/discount behavior compared to traditional ETFs. This paper investigates the premium and discount patterns observed in Bitcoin ETFs during first four-month period (January 11th, 2024, to May 17th, 2024). Our analysis reveals that these patterns differ significantly from those observed in traditional index ETFs, potentially exposing investors to additional risk factors. By identifying and analyzing these risk factors associated with Bitcoin ETF premiums/discounts, this paper aims to achieve two key objectives: Enhance market understanding: Equip and market and investors with a deeper comprehension of the unique liquidity risks inherent in Bitcoin ETFs. Provide a clearer risk management frameworks: Offer a clearer perspective on the risk-return profile of digital asset ETFs, specifically focusing on Bitcoin ETFs. Through a thorough analysis of premium/discount behavior and the underlying factors contributing to it, this paper strives to contribute valuable insights for investors navigating the evolving landscape of digital asset investments

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Premia in the Bitcoin Market

Ratmir Miftachov, Zijin Wang, Caio Almeida et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)