Summary

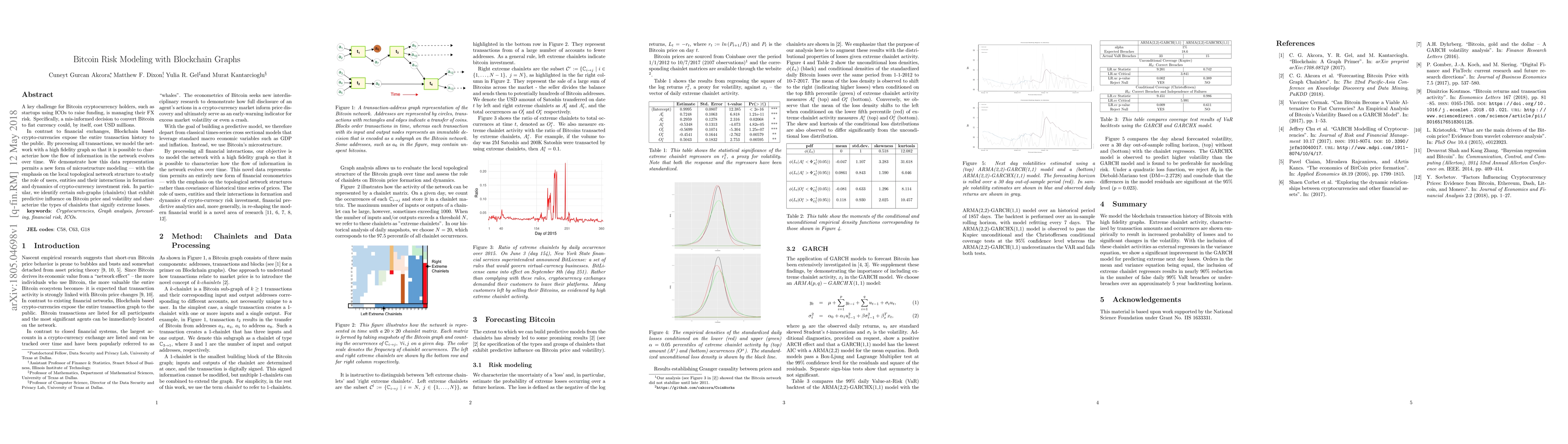

A key challenge for Bitcoin cryptocurrency holders, such as startups using ICOs to raise funding, is managing their FX risk. Specifically, a misinformed decision to convert Bitcoin to fiat currency could, by itself, cost USD millions. In contrast to financial exchanges, Blockchain based crypto-currencies expose the entire transaction history to the public. By processing all transactions, we model the network with a high fidelity graph so that it is possible to characterize how the flow of information in the network evolves over time. We demonstrate how this data representation permits a new form of microstructure modeling - with the emphasis on the topological network structures to study the role of users, entities and their interactions in formation and dynamics of crypto-currency investment risk. In particular, we identify certain sub-graphs ('chainlets') that exhibit predictive influence on Bitcoin price and volatility, and characterize the types of chainlets that signify extreme losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHawkes Process Modeling of Block Arrivals in Bitcoin Blockchain

Rui Luo, Vikram Krishnamurthy, Erik Blasch

A UML Profile for Bitcoin Blockchain

Javad Salimi Sartakhti, Behrouz Sefid-Dashti, Hassan Daghigh

| Title | Authors | Year | Actions |

|---|

Comments (0)