Summary

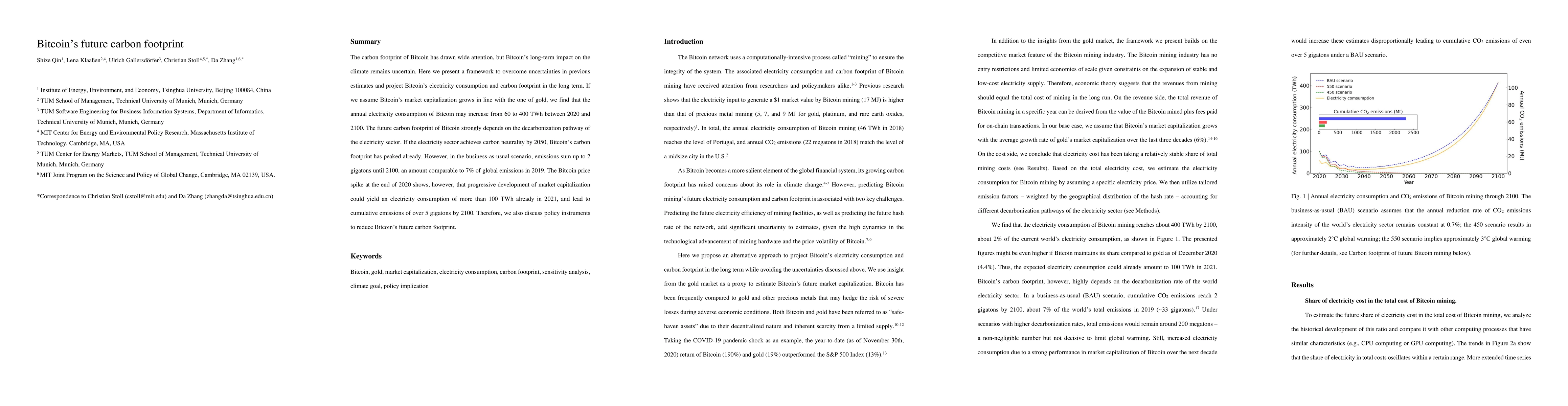

The carbon footprint of Bitcoin has drawn wide attention, but Bitcoin's long-term impact on the climate remains uncertain. Here we present a framework to overcome uncertainties in previous estimates and project Bitcoin's electricity consumption and carbon footprint in the long term. If we assume Bitcoin's market capitalization grows in line with the one of gold, we find that the annual electricity consumption of Bitcoin may increase from 60 to 400 TWh between 2020 and 2100. The future carbon footprint of Bitcoin strongly depends on the decarbonization pathway of the electricity sector. If the electricity sector achieves carbon neutrality by 2050, Bitcoin's carbon footprint has peaked already. However, in the business-as-usual scenario, emissions sum up to 2 gigatons until 2100, an amount comparable to 7% of global emissions in 2019. The Bitcoin price spike at the end of 2020 shows, however, that progressive development of market capitalization could yield an electricity consumption of more than 100 TWh already in 2021, and lead to cumulative emissions of over 5 gigatons by 2100. Therefore, we also discuss policy instruments to reduce Bitcoin's future carbon footprint.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe carbon footprint of IRAP

Jürgen Knödlseder, Philippe Garnier, Pierrick Martin et al.

The Sunk Carbon Fallacy: Rethinking Carbon Footprint Metrics for Effective Carbon-Aware Scheduling

David Irwin, Noman Bashir, Mohammad Shahrad et al.

The carbon footprint of astronomical research infrastructures

Jürgen Knödlseder

| Title | Authors | Year | Actions |

|---|

Comments (0)