Summary

Contemporary insurance theory is concentrated on models with different types of polices and shock events may influence the payments on some of them. Jordanova (2018) considered a model where a shock event contributes to the total claim amount with one and the same value of the claim sizes to different types of polices. Jordanova and Veleva (2021) went a step closer to real-life situations and allowed a shock event to cause different claim sizes to different types of polices. In that paper, the counting process is assumed to be Multinomial. Here it is replaced with different independent homogeneous Poison processes. The bivariate claim counting process is expressed in two different ways. Its marginals and conditional distributions are totally described. The mean square regression of these processes is computed. The Laplace-Stieltjes transforms and numerical characteristics of the total claim amount processes are obtained. The risk reserve process and the probabilities of ruin in infinite time are discussed. The risk reserve just before the ruin and the deficit (or the severity) at ruin are thoroughly investigated in the case when the initial capital is zero. Their means, probability mass functions, and probability generating functions are obtained. Although the model is constructed by a multivariate counting process, along the paper it is shown that the total claim amount process is stochastically equivalent to a univariate compound Poisson process. These allow us to reduce the considered risk model to a Cramer-Lundberg risk model, to use the corresponding results, and to make the conclusions for the new model. Analogous results can be obtained for more types of polices and more types of shock events. The results are applied in case when the claim sizes are exponentially distributed. Stochastically equivalent models could be analogously constructed in queuing theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

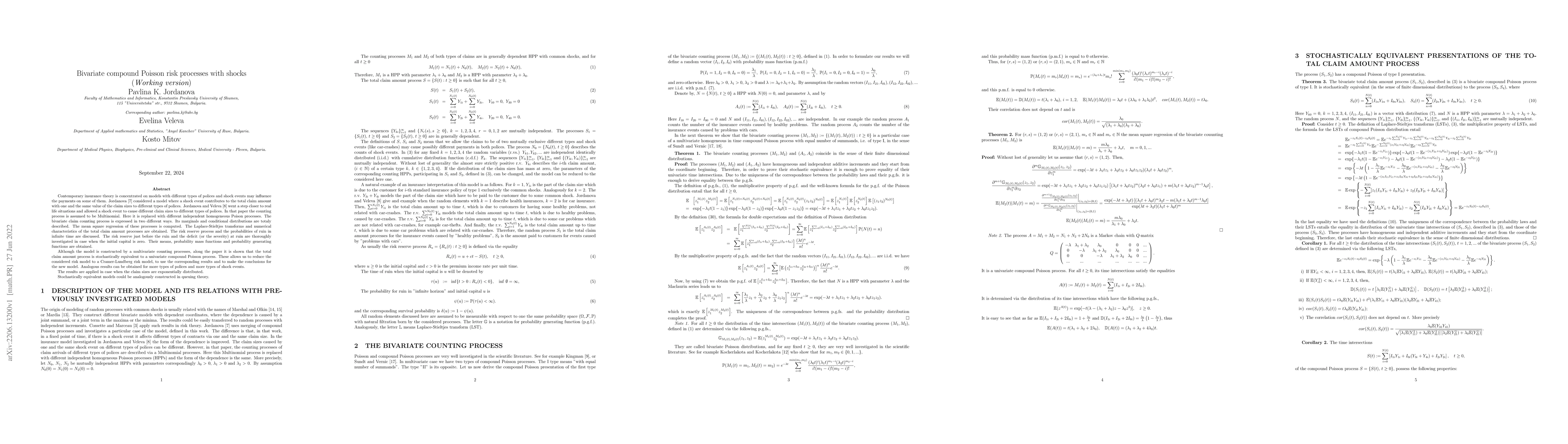

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)