Authors

Summary

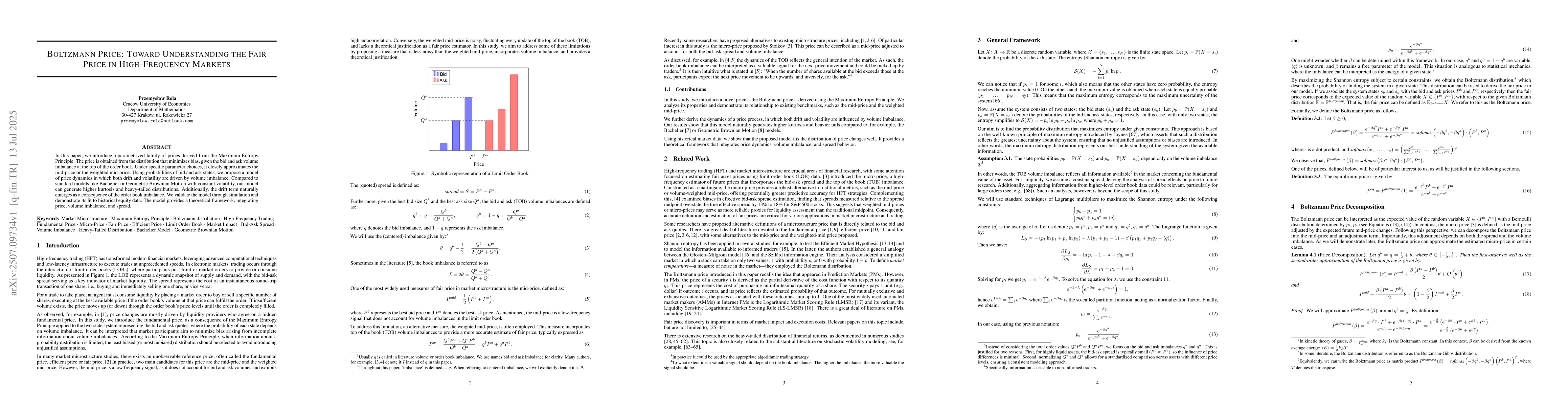

In this paper, we introduce a parametrized family of prices derived from the Maximum Entropy Principle. The price is obtained from the distribution that minimizes bias, given the bid and ask volume imbalance at the top of the order book. Under specific parameter choices, it closely approximates the mid-price or the weighted mid-price. Using probabilities of bid and ask states, we propose a model of price dynamics in which both drift and volatility are driven by volume imbalance. Compared to standard models like Bachelier or Geometric Brownian Motion with constant volatility, our model can generate higher kurtosis and heavy-tailed distributions. Additionally, the drift term naturally emerges as a consequence of the order book imbalance. We validate the model through simulation and demonstrate its fit to historical equity data. The model provides a theoretical framework, integrating price, volume imbalance, and spread.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Price Clustering in High-Frequency Prices

Vladimír Holý, Petra Tomanová

Price Discovery in Cryptocurrency Markets

Juan Plazuelo Pascual, Carlos Tardon Rubio, Juan Toro Cebada et al.

No citations found for this paper.

Comments (0)