Summary

Based on the recent paper by Delong et al. (2021), two distributions for the total claims amount (loss cost) are considered: Compound Poisson-gamma (CPG) and Tweedie. Each is used as an underlying distribution in the Bonus-Malus Scale (BMS) model described in the paper by Boucher (2023). The BMS model links the premium of an insurance contract to a function of the insurance experience of the related policy. In other words, the idea is to model the increase and the decrease in premiums for insureds that do or do not file claims. Therefore, our proposed models can be seen as a generalization of the paper of Delong et al. (2021) and an extension of the work of Boucher (2023). We applied our approach to a sample of data from a major insurance company in Canada. Data fit and predictability were analyzed. We showed that the studied models are exciting alternatives to consider from a practical point of view, and that predictive ratemaking models can address some importantpractical considerations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

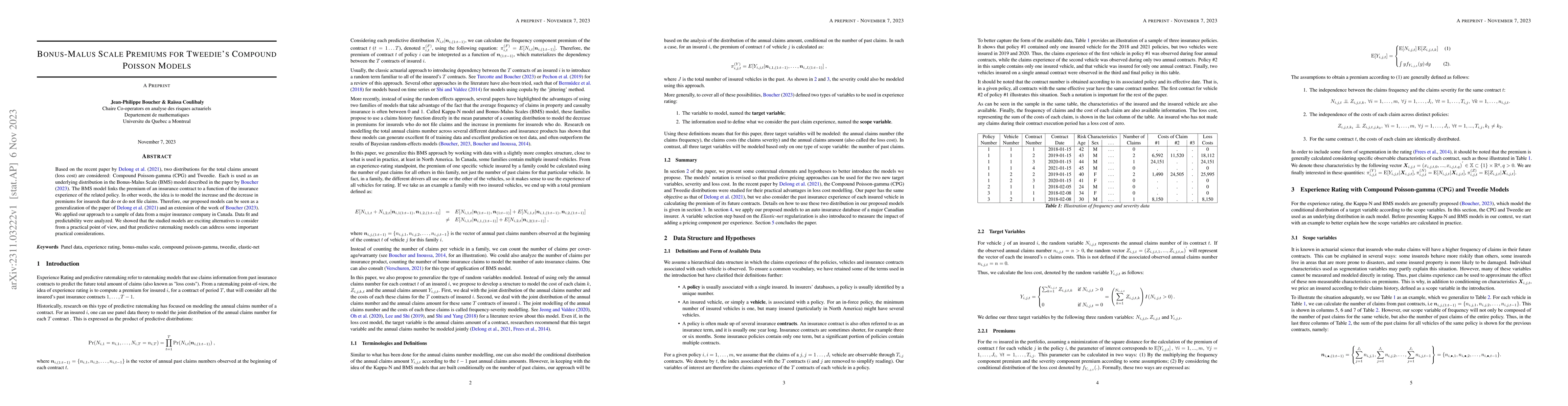

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)