Authors

Summary

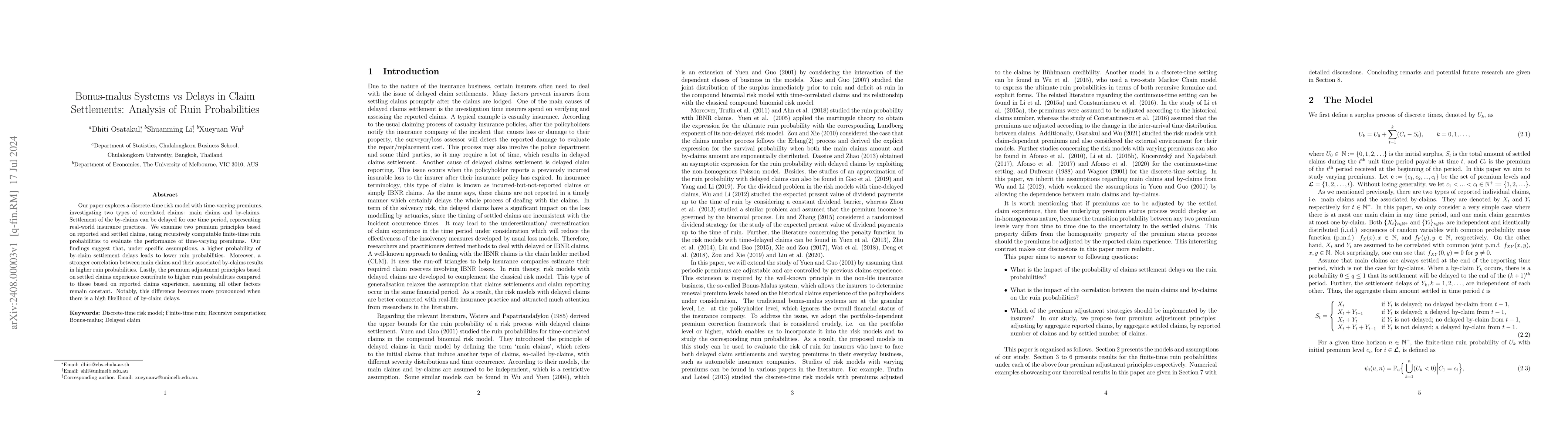

Our paper explores a discrete-time risk model with time-varying premiums, investigating two types of correlated claims: main claims and by-claims. Settlement of the by-claims can be delayed for one time period, representing real-world insurance practices. We examine two premium principles based on reported and settled claims, using recursively computable finite-time ruin probabilities to evaluate the performance of time-varying premiums. Our findings suggest that, under specific assumptions, a higher probability of by-claim settlement delays leads to lower ruin probabilities. Moreover, a stronger correlation between main claims and their associated by-claims results in higher ruin probabilities. Lastly, the premium adjustment principles based on settled claims experience contribute to higher ruin probabilities compared to those based on reported claims experience, assuming all other factors remain constant. Notably, this difference becomes more pronounced when there is a high likelihood of by-claim delays.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)