Summary

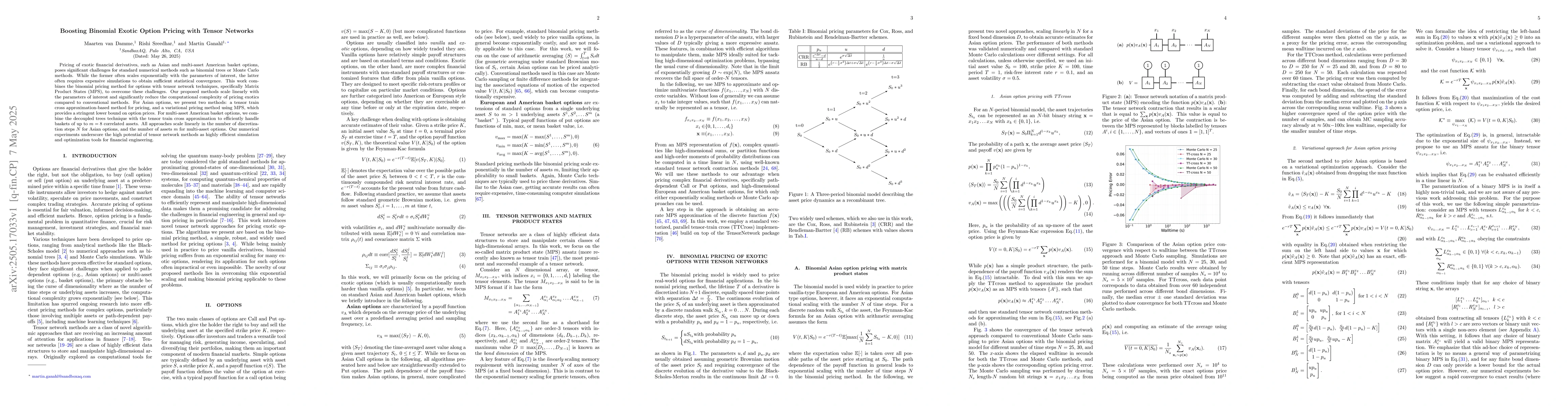

Pricing of exotic financial derivatives, such as Asian and multi-asset American basket options, poses significant challenges for standard numerical methods such as binomial trees or Monte Carlo methods. While the former often scales exponentially with the parameters of interest, the latter often requires expensive simulations to obtain sufficient statistical convergence. This work combines the binomial pricing method for options with tensor network techniques, specifically Matrix Product States (MPS), to overcome these challenges. Our proposed methods scale linearly with the parameters of interest and significantly reduce the computational complexity of pricing exotics compared to conventional methods. For Asian options, we present two methods: a tensor train cross approximation-based method for pricing, and a variational pricing method using MPS, which provides a stringent lower bound on option prices. For multi-asset American basket options, we combine the decoupled trees technique with the tensor train cross approximation to efficiently handle baskets of up to $m = 8$ correlated assets. All approaches scale linearly in the number of discretization steps $N$ for Asian options, and the number of assets $m$ for multi-asset options. Our numerical experiments underscore the high potential of tensor network methods as highly efficient simulation and optimization tools for financial engineering.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research combines the binomial pricing method for options with tensor network techniques, specifically Matrix Product States (MPS), to efficiently price exotic financial derivatives such as Asian and multi-asset American basket options.

Key Results

- Proposed methods scale linearly with the parameters of interest, significantly reducing computational complexity compared to conventional methods.

- Two methods for Asian options are presented: a tensor train cross approximation-based pricing method and a variational pricing method using MPS, providing a lower bound on option prices.

- For multi-asset American basket options, a combination of decoupled trees with tensor train cross approximation efficiently handles baskets of up to 8 correlated assets, scaling linearly with the number of assets.

Significance

This research highlights the potential of tensor network methods as highly efficient simulation and optimization tools for financial engineering, addressing the challenges posed by standard numerical methods in pricing exotic options.

Technical Contribution

The main technical contribution lies in the application of tensor network techniques, specifically Matrix Product States (MPS), to the binomial pricing method for exotic options, resulting in linear scaling and reduced computational complexity.

Novelty

This work stands out by integrating tensor networks with the binomial method for pricing exotic options, offering novel approaches for Asian and multi-asset American basket options that surpass the limitations of traditional methods.

Limitations

- The paper does not discuss potential limitations or constraints of the proposed methods in detail.

- Real-world applicability and robustness under various market conditions are not explicitly addressed.

Future Work

- Exploration of the proposed methods' performance on a broader range of exotic options and under different market scenarios.

- Investigation into further enhancing the efficiency and accuracy of tensor network-based pricing methods.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning parameter dependence for Fourier-based option pricing with tensor trains

Koichi Miyamoto, Rihito Sakurai, Haruto Takahashi

No citations found for this paper.

Comments (0)