Summary

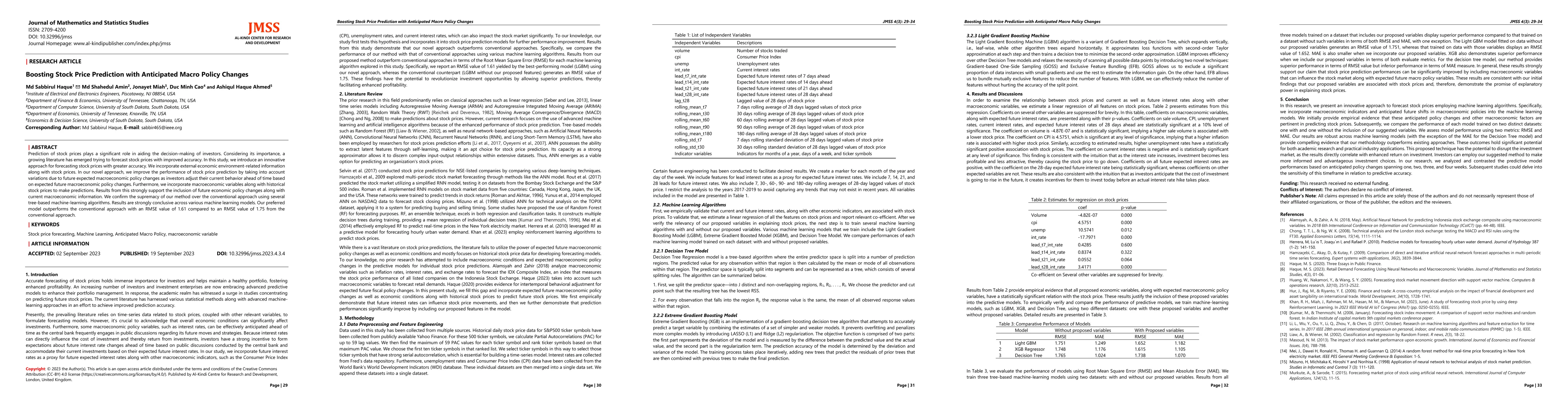

Prediction of stock prices plays a significant role in aiding the decision-making of investors. Considering its importance, a growing literature has emerged trying to forecast stock prices with improved accuracy. In this study, we introduce an innovative approach for forecasting stock prices with greater accuracy. We incorporate external economic environment-related information along with stock prices. In our novel approach, we improve the performance of stock price prediction by taking into account variations due to future expected macroeconomic policy changes as investors adjust their current behavior ahead of time based on expected future macroeconomic policy changes. Furthermore, we incorporate macroeconomic variables along with historical stock prices to make predictions. Results from this strongly support the inclusion of future economic policy changes along with current macroeconomic information. We confirm the supremacy of our method over the conventional approach using several tree-based machine-learning algorithms. Results are strongly conclusive across various machine learning models. Our preferred model outperforms the conventional approach with an RMSE value of 1.61 compared to an RMSE value of 1.75 from the conventional approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Stock Price Prediction

Furkan Karadaş, Bahaeddin Eravcı, Ahmet Murat Özbayoğlu

| Title | Authors | Year | Actions |

|---|

Comments (0)