Summary

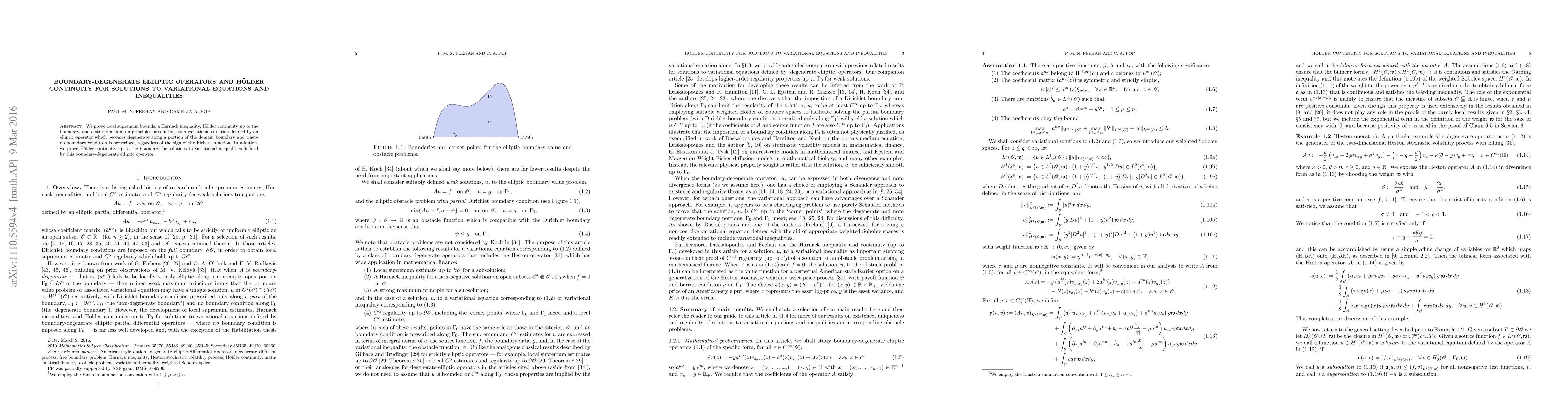

The Heston stochastic volatility process, which is widely used as an asset price model in mathematical finance, is a paradigm for a degenerate diffusion process where the degeneracy in the diffusion coefficient is proportional to the square root of the distance to the boundary of the half-plane. The generator of this process with killing, called the elliptic Heston operator, is a second-order, degenerate-elliptic partial differential operator whose coefficients have linear growth in the spatial variables and where the degeneracy in the operator symbol is proportional to the distance to the boundary of the half-plane. With the aid of weighted Sobolev spaces, we prove supremum bounds, a Harnack inequality, and H\"older continuity near the boundary for solutions to variational equations defined by the elliptic Heston operator, as well as H\"older continuity up to the boundary for solutions to variational inequalities defined by the elliptic Heston operator. In mathematical finance, solutions to obstacle problems for the elliptic Heston operator correspond to value functions for perpetual American-style options on the underlying asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Boundary Regularity for Uniformly Degenerate Elliptic Equations

Qing Han, Jiongduo Xie

| Title | Authors | Year | Actions |

|---|

Comments (0)