Summary

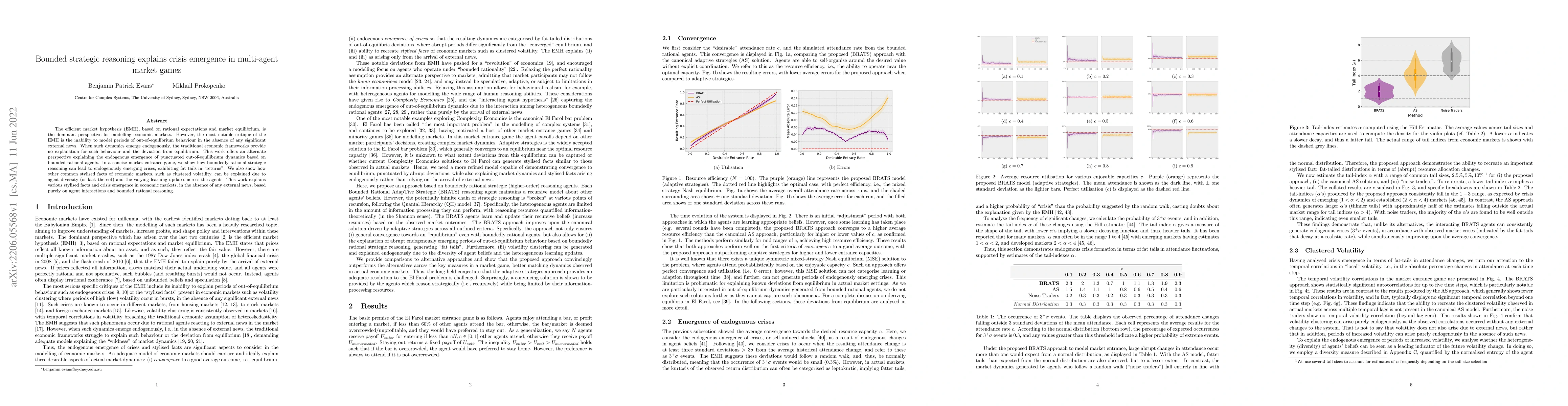

The efficient market hypothesis (EMH), based on rational expectations and market equilibrium, is the dominant perspective for modelling economic markets. However, the most notable critique of the EMH is the inability to model periods of out-of-equilibrium behaviour in the absence of any significant external news. When such dynamics emerge endogenously, the traditional economic frameworks provide no explanation for such behaviour and the deviation from equilibrium. This work offers an alternate perspective explaining the endogenous emergence of punctuated out-of-equilibrium dynamics based on bounded rational agents. In a concise market entrance game, we show how boundedly rational strategic reasoning can lead to endogenously emerging crises, exhibiting fat tails in "returns". We also show how other common stylised facts of economic markets, such as clustered volatility, can be explained due to agent diversity (or lack thereof) and the varying learning updates across the agents. This work explains various stylised facts and crisis emergence in economic markets, in the absence of any external news, based purely on agent interactions and bounded rational reasoning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResponsibility-aware Strategic Reasoning in Probabilistic Multi-Agent Systems

Nir Oren, Muhammad Najib, Chunyan Mu

Reasoning about Strategic Abilities in Stochastic Multi-agent Systems

Yedi Zhang, Taolue Chen, Fu Song et al.

Enhancing Language Agent Strategic Reasoning through Self-Play in Adversarial Games

Yanghua Xiao, Jian Xie, Siyu Yuan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)