Summary

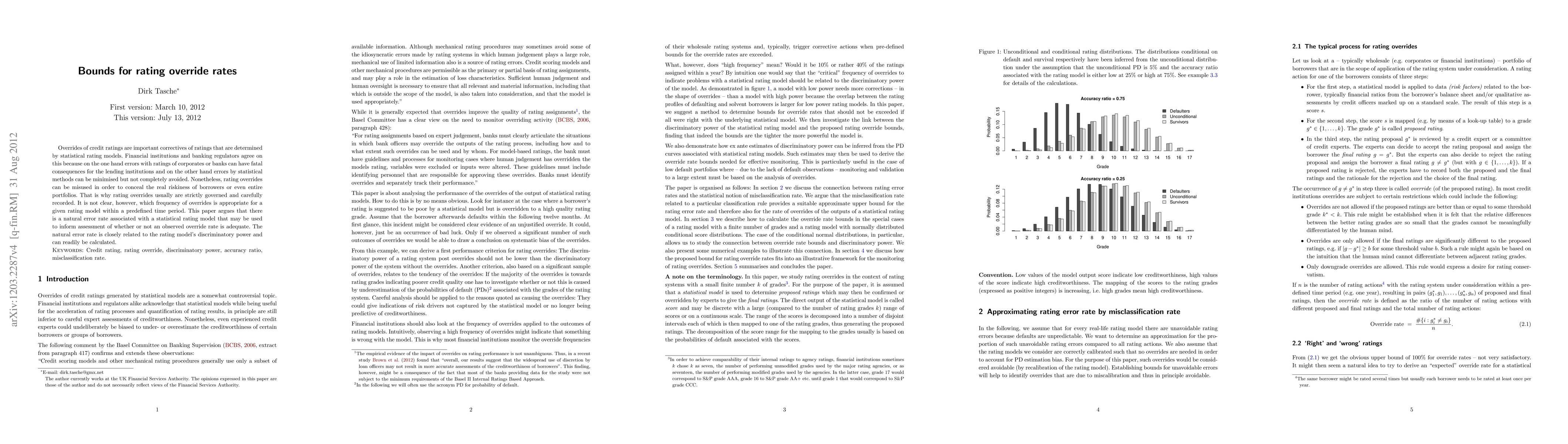

Overrides of credit ratings are important correctives of ratings that are determined by statistical rating models. Financial institutions and banking regulators agree on this because on the one hand errors with ratings of corporates or banks can have fatal consequences for the lending institutions and on the other hand errors by statistical methods can be minimised but not completely avoided. Nonetheless, rating overrides can be misused in order to conceal the real riskiness of borrowers or even entire portfolios. That is why rating overrides usually are strictly governed and carefully recorded. It is not clear, however, which frequency of overrides is appropriate for a given rating model within a predefined time period. This paper argues that there is a natural error rate associated with a statistical rating model that may be used to inform assessment of whether or not an observed override rate is adequate. The natural error rate is closely related to the rating model's discriminatory power and can readily be calculated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)