Summary

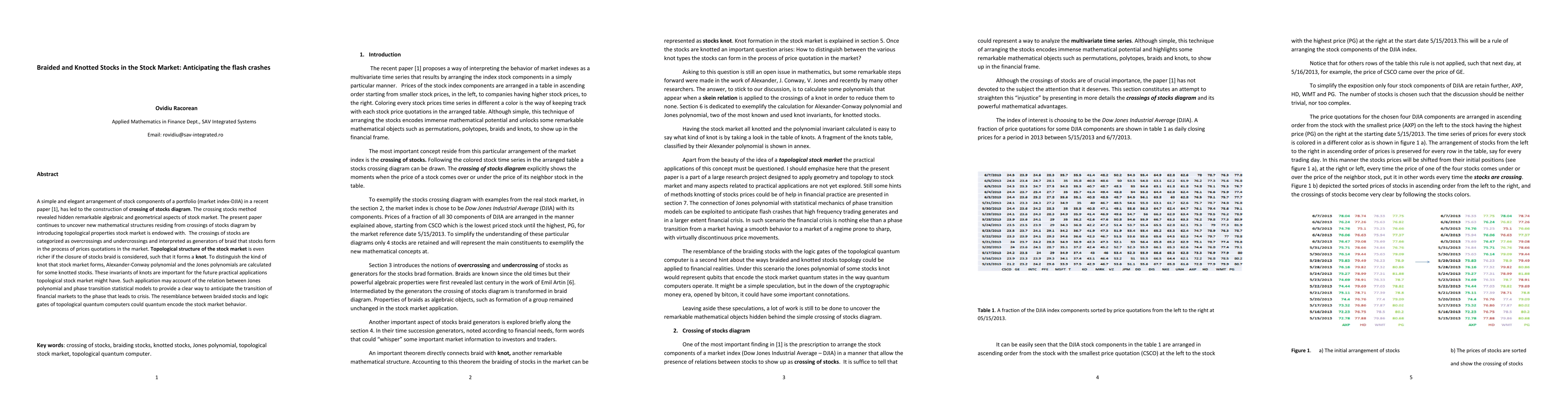

A simple and elegant arrangement of stock components of a portfolio (market index-DJIA) in a recent paper [1], has led to the construction of crossing of stocks diagram. The crossing stocks method revealed hidden remarkable algebraic and geometrical aspects of stock market. The present paper continues to uncover new mathematical structures residing from crossings of stocks diagram by introducing topological properties stock market is endowed with. The crossings of stocks are categorized as overcrossings and undercrossings and interpreted as generators of braid that stocks form in the process of prices quotations in the market. Topological structure of the stock market is even richer if the closure of stocks braid is considered, such that it forms a knot. To distinguish the kind of knot that stock market forms, Alexander-Conway polynomial and the Jones polynomials are calculated for some knotted stocks. These invariants of knots are important for the future practical applications topological stock market might have. Such application may account of the relation between Jones polynomial and phase transition statistical models to provide a clear way to anticipate the transition of financial markets to the phase that leads to crisis. The resemblance between braided stocks and logic gates of topological quantum computers could quantum encode the stock market behavior.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research introduces a topological approach to the stock market using braids and knots formed by stock price quotations. Crossings of stocks are categorized as overcrossings and undercrossings, forming braid generators that 'write words' providing insights into market state. Braids are closed to form knots, which are classified using Alexander-Conway and Jones polynomials.

Key Results

- Stock market behavior can be represented as braids and knots, revealing hidden algebraic and geometrical aspects.

- The concatenation of braids follows group theory under concatenation, applicable to stock market circumstances.

- Braid words can provide valuable information about stock price trends (bullish or bearish).

- Knots formed by stocks can be simplified using Reidemeister moves, and their types can be distinguished using Alexander-Conway and Jones polynomials.

- Jones polynomial of knotted stocks could potentially anticipate mini-flash crashes and financial crises by relating to statistical mechanics phase transition models.

Significance

This research presents a novel way to understand and potentially predict stock market behavior using topology, which could benefit investors and regulators by providing insights into market phase transitions and possible crises.

Technical Contribution

The paper introduces a topological framework for analyzing stock market behavior, using braids and knots to represent and classify stock price movements, and proposes the use of knot polynomials for potential predictive applications.

Novelty

The research is novel in its application of topological concepts, specifically braids and knots, to model and analyze stock market behavior, offering a fresh perspective distinct from traditional financial modeling approaches.

Limitations

- The methodology is still in the exploratory phase and requires further development for practical applications.

- The paper does not provide extensive empirical validation of the proposed topological model against real-world stock market data.

- The speculative aspects regarding quantum encoding of stock market behavior in topological quantum computers need further investigation.

Future Work

- Explore and validate the proposed topological model with extensive real-world stock market data.

- Investigate the potential of Jones polynomial in predicting mini-flash crashes and larger financial crises.

- Examine the resemblance between braided stock markets and topological quantum computers for practical applications in finance.

- Develop algorithms for practical use of topological stock market insights by financial professionals.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)