Summary

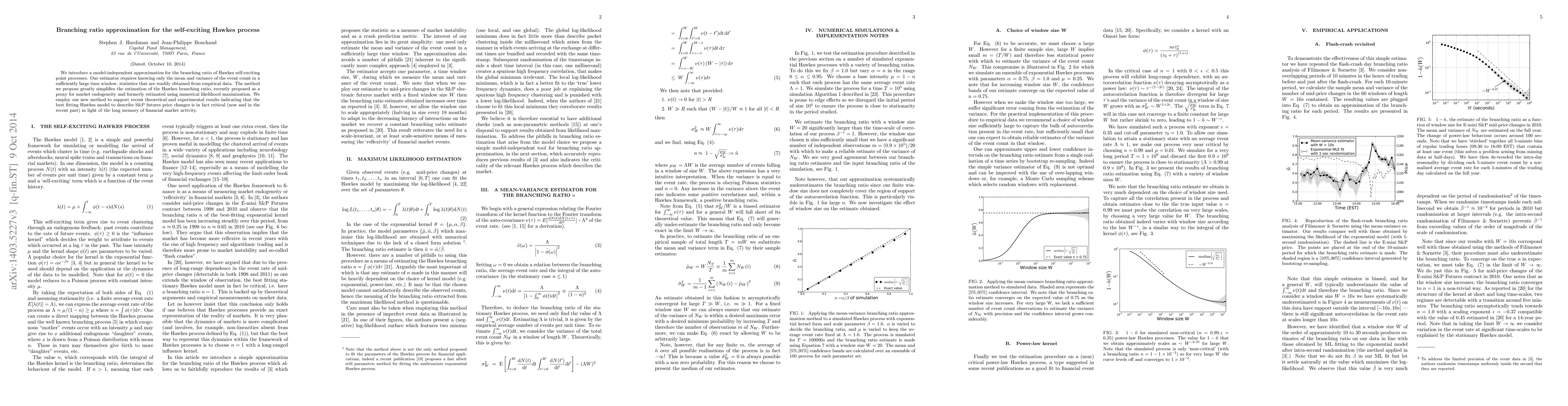

We introduce a model-independent approximation for the branching ratio of Hawkes self-exciting point processes. Our estimator requires knowing only the mean and variance of the event count in a sufficiently large time window, statistics that are readily obtained from empirical data. The method we propose greatly simplifies the estimation of the Hawkes branching ratio, recently proposed as a proxy for market endogeneity and formerly estimated using numerical likelihood maximisation. We employ our new method to support recent theoretical and experimental results indicating that the best fitting Hawkes model to describe S&P futures price changes is in fact critical (now and in the recent past) in light of the long memory of financial market activity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximation of bayesian Hawkes process models with Inlabru

Finn Lindgren, Francesco Serafini, Mark Naylor

| Title | Authors | Year | Actions |

|---|

Comments (0)