Authors

Summary

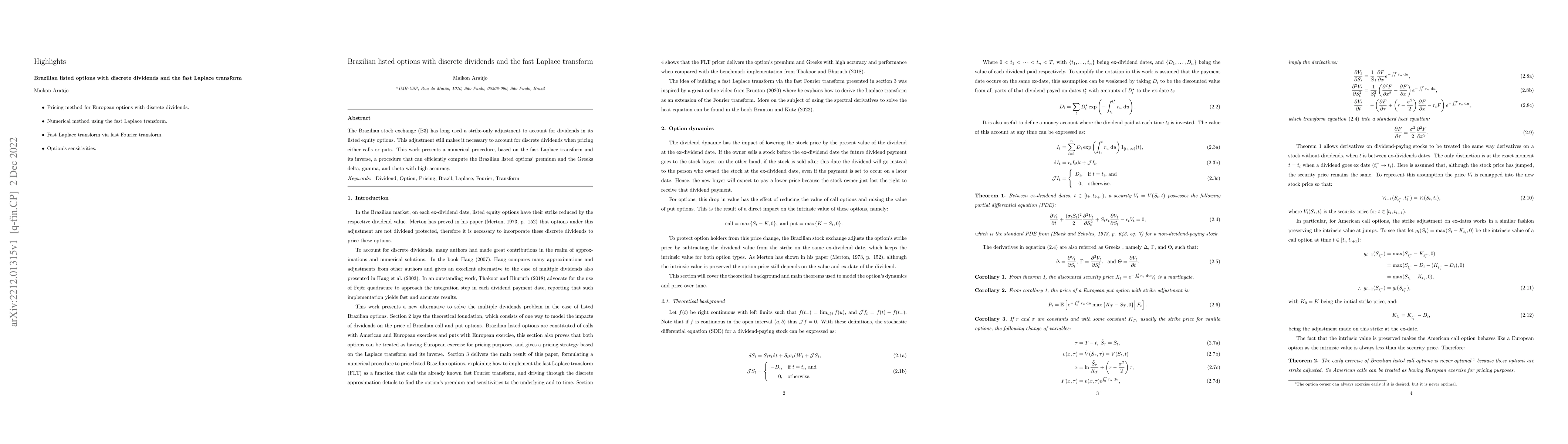

The Brazilian stock exchange (B3) has long used a strike-only adjustment to account for dividends in its listed equity options. This adjustment still makes it necessary to account for discrete dividends when pricing either calls or puts. This work presents a numerical procedure, based on the fast Laplace transform and its inverse, a procedure that can efficiently compute the Brazilian listed options' premium and the Greeks delta, gamma, and theta with high accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)