Summary

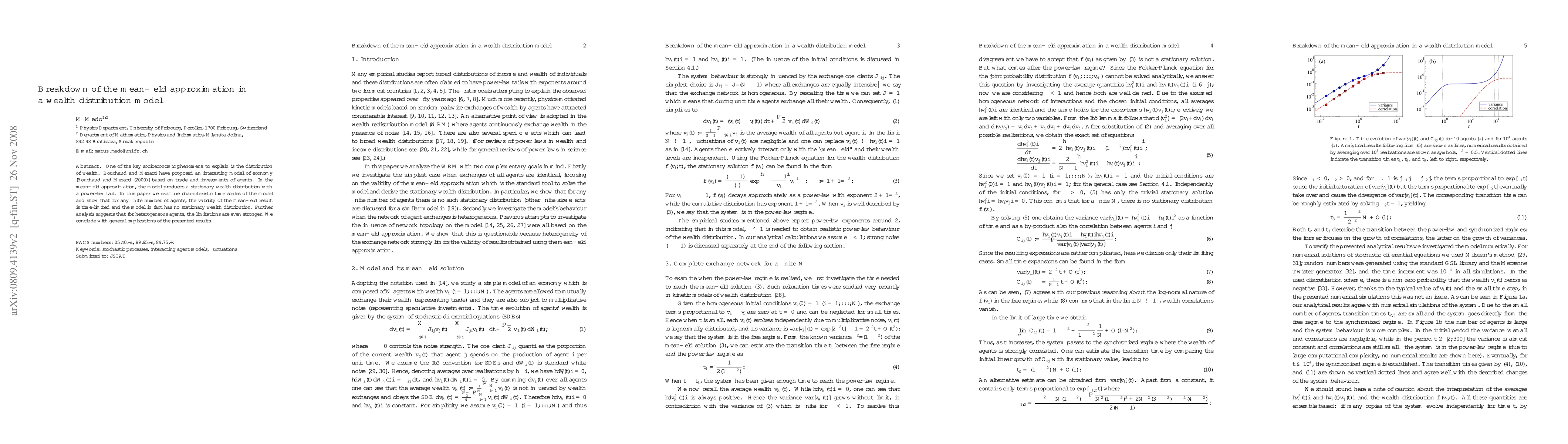

One of the key socioeconomic phenomena to explain is the distribution of wealth. Bouchaud and M\'ezard have proposed an interesting model of economy [Bouchaud and M\'ezard (2000)] based on trade and investments of agents. In the mean-field approximation, the model produces a stationary wealth distribution with a power-law tail. In this paper we examine characteristic time scales of the model and show that for any finite number of agents, the validity of the mean-field result is time-limited and the model in fact has no stationary wealth distribution. Further analysis suggests that for heterogeneous agents, the limitations are even stronger. We conclude with general implications of the presented results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)