Authors

Summary

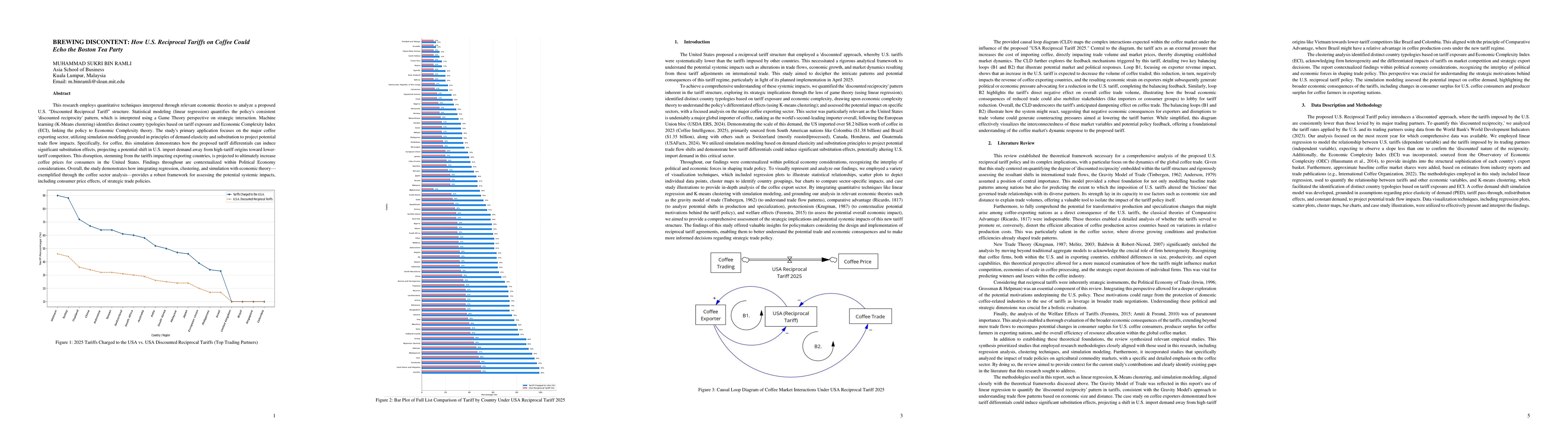

This research employs quantitative techniques interpreted through relevant economic theories to analyze a proposed U.S. "Discounted Reciprocal Tariff" structure. Statistical modeling (linear regression) quantifies the policy's consistent 'discounted reciprocity' pattern, which is interpreted using a Game Theory perspective on strategic interaction. Machine learning (K-Means clustering) identifies distinct country typologies based on tariff exposure and Economic Complexity Index (ECI), linking the policy to Economic Complexity theory. The study's primary application focuses on the major coffee exporting sector, utilizing simulation modeling grounded in principles of demand elasticity and substitution to project potential trade flow impacts. Specifically, for coffee, this simulation demonstrates how the proposed tariff differentials can induce significant substitution effects, projecting a potential shift in U.S. import demand away from high-tariff origins toward lower-tariff competitors. This disruption, stemming from the tariffs impacting exporting countries, is projected to ultimately increase coffee prices for consumers in the United States. Findings throughout are contextualized within Political Economy considerations. Overall, the study demonstrates how integrating regression, clustering, and simulation with economic theory exemplified through the coffee sector analysis provides a robust framework for assessing the potential systemic impacts, including consumer price effects, of strategic trade policies.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research uses quantitative techniques including linear regression, K-Means clustering, and simulation modeling grounded in demand elasticity and substitution principles, interpreted through Game Theory and Economic Complexity theory.

Key Results

- Discounted Reciprocal Tariff structure shows a consistent 'discounted reciprocity' pattern.

- Machine learning identifies distinct country typologies based on tariff exposure and Economic Complexity Index (ECI).

- Proposed tariff differentials can induce significant substitution effects in U.S. coffee import demand.

Significance

This study provides a robust framework for assessing potential systemic impacts, including consumer price effects, of strategic trade policies, using the coffee sector as a case study.

Technical Contribution

Integration of regression, clustering, and simulation with economic theory to analyze strategic trade policy impacts.

Novelty

This research distinguishes itself by contextualizing strategic trade policy analysis within Political Economy considerations and demonstrating its application through a detailed coffee sector case study.

Limitations

- The study focuses on the coffee sector, so findings may not generalize to other commodities without further analysis.

- Simulation modeling relies on certain assumptions about demand elasticity and substitution that may not hold in all scenarios.

Future Work

- Explore the applicability of this framework to other agricultural or manufactured goods.

- Investigate the long-term effects of such strategic trade policies on global trade dynamics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModerate coffee and tea consumption is associated with slower cognitive decline.

Sewell, Kelsey R, Martins, Ralph N, Rainey-Smith, Stephanie R et al.

Association between coffee and tea consumption and the risk of macrovascular complications in type 2 diabetes: a UK Biobank cohort study.

Wang, Bo, Ma, Ting, Yang, Lingling et al.

No citations found for this paper.

Comments (0)