Authors

Summary

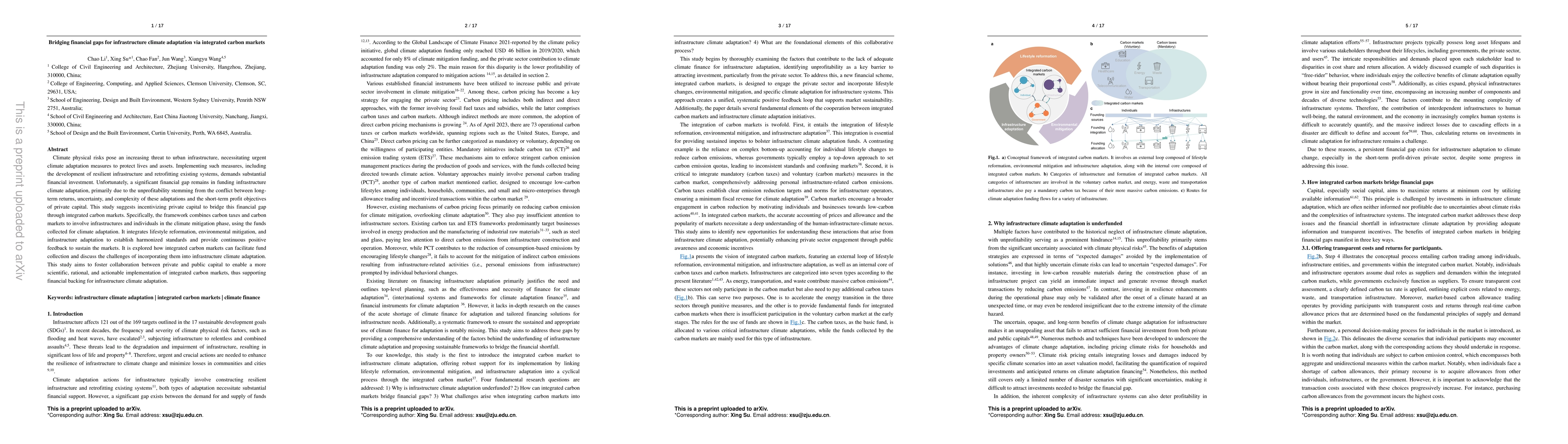

Climate physical risks pose an increasing threat to urban infrastructure, necessitating urgent climate adaptation measures to protect lives and assets. Implementing such measures, including the development of resilient infrastructure and retrofitting existing systems, demands substantial financial investment. Unfortunately, a significant financial gap remains in funding infrastructure climate adaptation, primarily due to the unprofitability stemming from the conflict between long-term returns, uncertainty, and complexity of these adaptations and the short-term profit objectives of private capital. This study suggests incentivizing private capital to bridge this financial gap through integrated carbon markets. Specifically, the framework combines carbon taxes and carbon markets to involve infrastructures and individuals in the climate mitigation phase, using the funds collected for climate adaptation. It integrates lifestyle reformation, environmental mitigation, and infrastructure adaptation to establish harmonized standards and provide continuous positive feedback to sustain the markets. It is explored how integrated carbon markets can facilitate fund collection and discuss the challenges of incorporating them into infrastructure climate adaptation. This study aims to foster collaboration between private and public capital to enable a more scientific, rational, and actionable implementation of integrated carbon markets, thus supporting financial backing for infrastructure climate adaptation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe resilience of China's financial markets: With a focus on the impact of its climate policy uncertainty

Si-yao Wei, Wei-xing Zhou

Fragility Modeling of Power Grid Infrastructure for Addressing Climate Change Risks and Adaptation

Sotirios Argyroudis, Mathaios Panteli, George Karagiannakis

No citations found for this paper.

Comments (0)