Summary

We begin with a retrospective analysis of three major U.S. airline mergers and document the sensitivity of the findings, particularly questioning whether market conditions evolve similarly for treated and control markets. We then develop a structural model that clarifies this and other assumptions implicit in retrospective analyses and separates efficiency gains from increases in firms' conduct. Using only pre-merger data, we propose a reduced-form approach that leverages exogenous changes in market structure to forecast merger effects. Finally, we use structural prospective merger simulations with our other estimates for a comprehensive evaluation. This bridging of approaches uncovers a fundamental tension: either efficiency gains were limited or, if they were significant, they were accompanied and offset by coordinated effects.

AI Key Findings

Generated Jun 10, 2025

Methodology

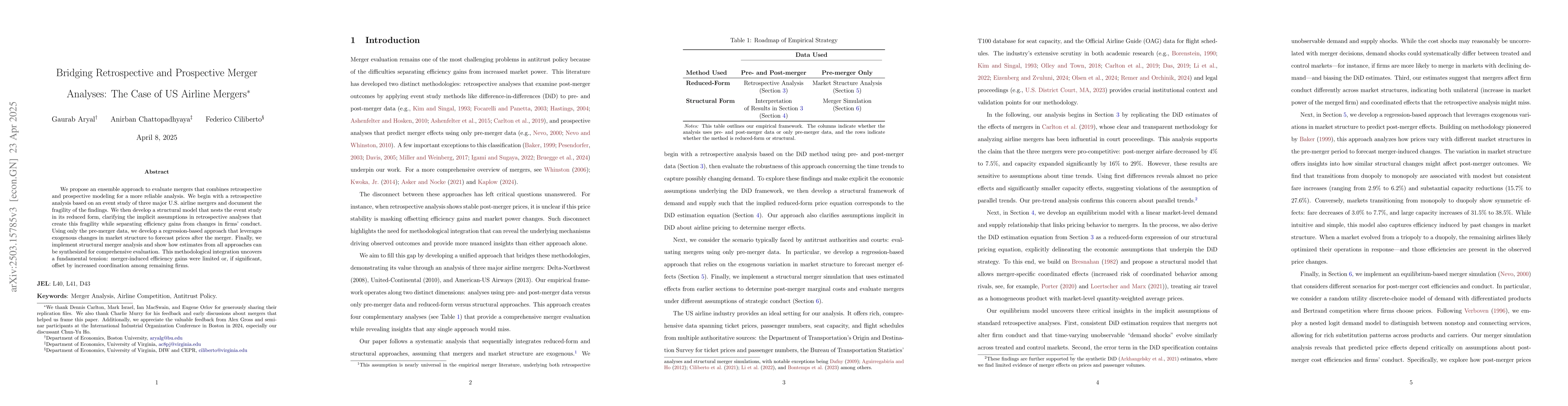

The research employs a mixed methodology, combining retrospective and prospective analyses of US airline mergers. It uses a structural model to clarify assumptions in retrospective analyses and separates efficiency gains from conduct changes. A reduced-form approach is proposed, leveraging exogenous changes in market structure to forecast merger effects, using only pre-merger data.

Key Results

- The study finds a fundamental tension: either efficiency gains were limited or, if significant, they were accompanied and offset by coordinated effects.

- Significant negative price sensitivities for DL-NW and UA-CO mergers, while for AA-US, it is imprecise.

- Mergers' cost effects vary: increasing for DL-NW and AA-US, decreasing for UA-CO.

- Market structure-specific conduct specifications reveal substantial reductions in competition, particularly in DL-NW markets.

- Implied price effects of mergers suggest heterogeneous outcomes across the three mergers, with DL-NW and AA-US leading to price reductions, while UA-CO led to a modest price increase.

Significance

This research enhances understanding of merger effects in the airline industry, highlighting the importance of considering both price and conduct changes, as well as efficiency gains and market structure.

Technical Contribution

The paper bridges structural and reduced-form approaches, providing a comprehensive evaluation of merger effects in the airline industry, and revealing a trade-off between efficiency and market power.

Novelty

This research distinguishes itself by explicitly making the trade-off between efficiency and market power clear, complementing existing merger evaluation research, and emphasizing the importance of industry-specific details in prospective merger analyses.

Limitations

- The study relies on assumptions of homogeneous products, linear demand, and linear costs.

- The analysis does not fully capture merger-specific efficiencies, such as proprietary fleet optimization between specific carriers.

Future Work

- Extend the framework to incorporate endogenous market structure and product characteristics.

- Allow product characteristics to change with mergers and maintain transparency in the methodology.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)