Summary

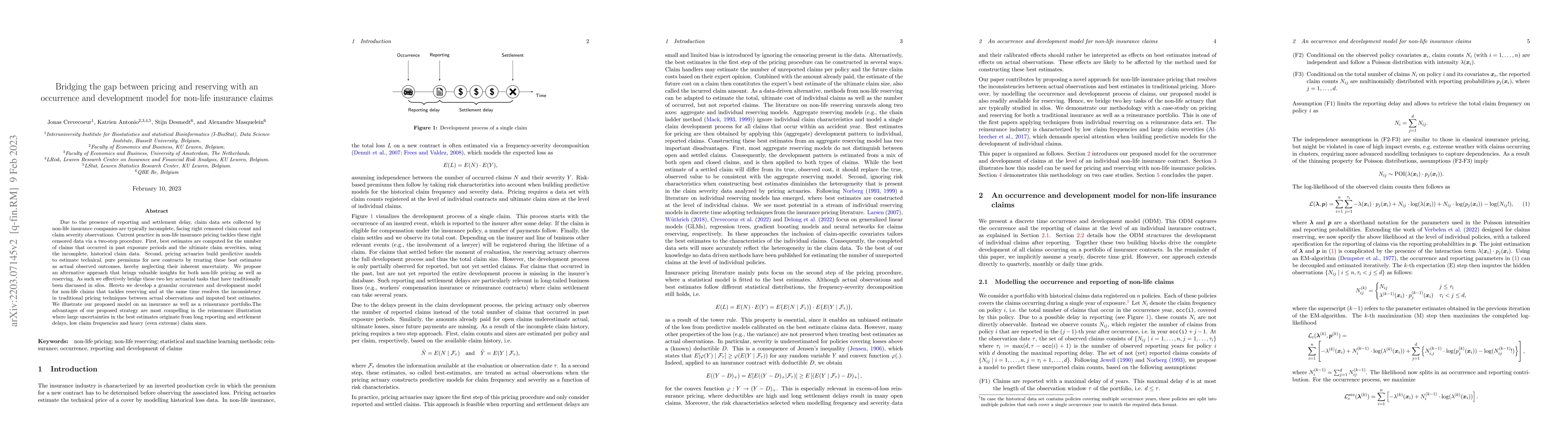

Due to the presence of reporting and settlement delay, claim data sets collected by non-life insurance companies are typically incomplete, facing right censored claim count and claim severity observations. Current practice in non-life insurance pricing tackles these right censored data via a two-step procedure. First, best estimates are computed for the number of claims that occurred in past exposure periods and the ultimate claim severities, using the incomplete, historical claim data. Second, pricing actuaries build predictive models to estimate technical, pure premiums for new contracts by treating these best estimates as actual observed outcomes, hereby neglecting their inherent uncertainty. We propose an alternative approach that brings valuable insights for both non-life pricing as well as reserving. As such we effectively bridge these two key actuarial tasks that have traditionally been discussed in silos. Hereto we develop a granular occurrence and development model for non-life claims that tackles reserving and at the same time resolves the inconsistency in traditional pricing techniques between actual observations and imputed best estimates. We illustrate our proposed model on an insurance as well as a reinsurance portfolio. The advantages of our proposed strategy are most compelling in the reinsurance illustration where large uncertainties in the best estimates originate from long reporting and settlement delays, low claim frequencies and heavy (even extreme) claim sizes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)