Authors

Summary

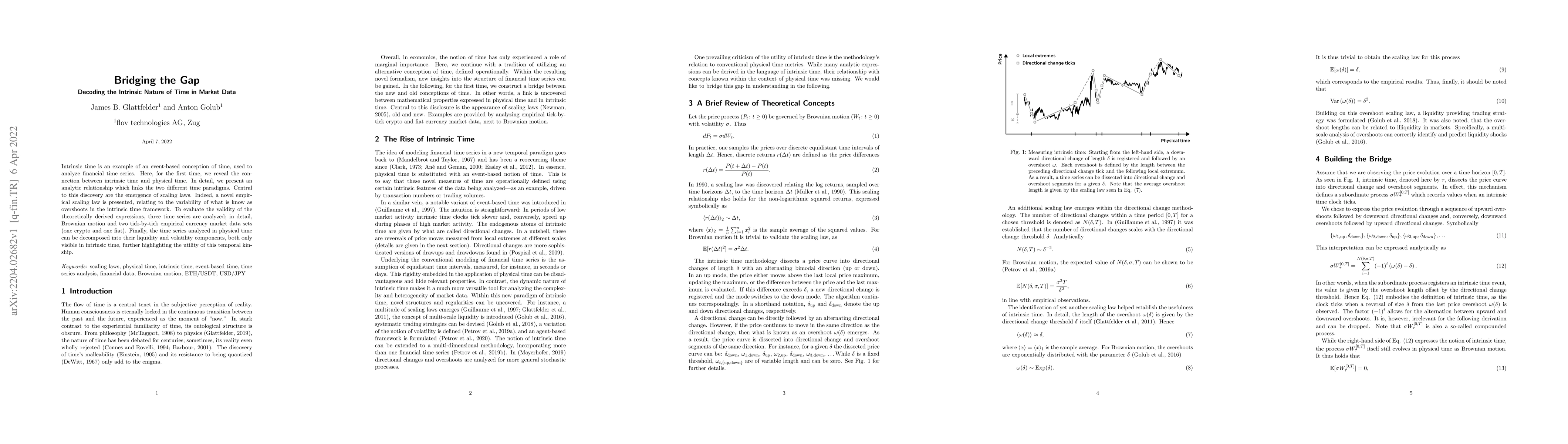

Intrinsic time is an example of an event-based conception of time, used to analyze financial time series. Here, for the first time, we reveal the connection between intrinsic time and physical time. In detail, we present an analytic relationship which links the two different time paradigms. Central to this discovery are the emergence of scaling laws. Indeed, a novel empirical scaling law is presented, relating to the variability of what is know as overshoots in the intrinsic time framework. To evaluate the validity of the theoretically derived expressions, three time series are analyzed; in detail, Brownian motion and two tick-by-tick empirical currency market data sets (one crypto and one fiat). Finally, the time series analyzed in physical time can be decomposed into their liquidity and volatility components, both only visible in intrinsic time, further highlighting the utility of this temporal kinship.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMITA: Bridging the Gap between Model and Data for Test-time Adaptation

Fei Sun, Xueqi Cheng, Huawei Shen et al.

Image Intrinsic Scale Assessment: Bridging the Gap Between Quality and Resolution

Vlad Hosu, Lorenzo Agnolucci, Daisuke Iso et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)