Summary

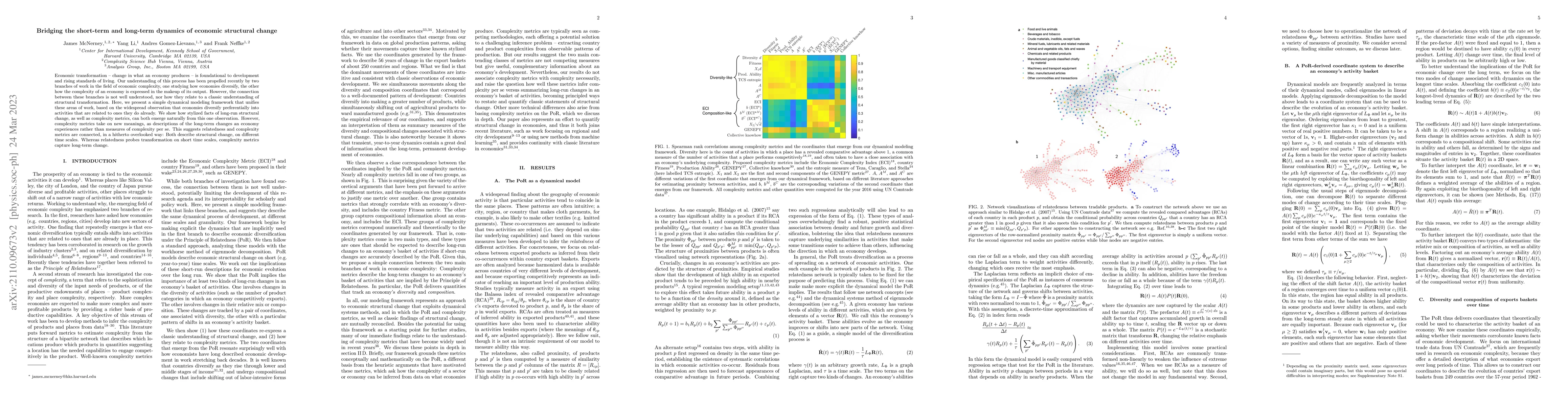

Economic transformation -- change in what an economy produces -- is foundational to development and rising standards of living. Our understanding of this process has been propelled recently by two branches of work in the field of economic complexity, one studying how economies diversify, the other how the complexity of an economy is expressed in the makeup of its output. However, the connection between these branches is not well understood, nor how they relate to a classic understanding of structural transformation. Here, we present a simple dynamical modeling framework that unifies these areas of work, based on the widespread observation that economies diversify preferentially into activities that are related to ones they do already. We show how stylized facts of long-run structural change, as well as complexity metrics, can both emerge naturally from this one observation. However, complexity metrics take on new meanings, as descriptions of the long-term changes an economy experiences rather than measures of complexity per se. This suggests relatedness and complexity metrics are connected, in a hitherto overlooked way: Both describe structural change, on different time scales. Whereas relatedness probes transformation on short time scales, complexity metrics capture long-term change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInferring the Long-Term Causal Effects of Long-Term Treatments from Short-Term Experiments

Aurélien Bibaut, Nathan Kallus, Allen Tran

| Title | Authors | Year | Actions |

|---|

Comments (0)