Summary

In a recent paper, Bouchard, Elie and Reveillac \cite{BER} have studied a new class of Backward Stochastic Differential Equations with weak terminal condition, for which the $T$-terminal value $Y_T$ of the solution $(Y,Z)$ is not fixed as a random variable, but only satisfies a constraint of the form $E[\Psi(Y_T)] \geq m.$ The aim of this paper is to introduce a more general class of BSDEs with {\em nonlinear weak terminal condition}. More precisely, the constraint takes the form $\mathcal{E}^f_{0,T}[\Psi(Y_T)] \geq m,$ where $\mathcal{E}^f$ represents the $f$-conditional expectation associated to a {\em nonlinear driver} $f$. We carry out a similar analysis as in \cite{BER} of the value function corresponding to the minimal solution $Y$ of the BSDE with nonlinear weak terminal condition: we study the regularity, establish the main properties, in particular continuity and convexity with respect to the parameter $m$, and finally provide a dual representation and the existence of an optimal control in the case of concave constraints. From a financial point of view, our study is closely related to the approximative hedging of an European option under dynamic risk measures constraints. The nonlinearity $f$ raises subtle difficulties, highlighted throughout the paper, which cannot be handled by the arguments used in the case of classical expectations constraints studied in \cite{BER}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

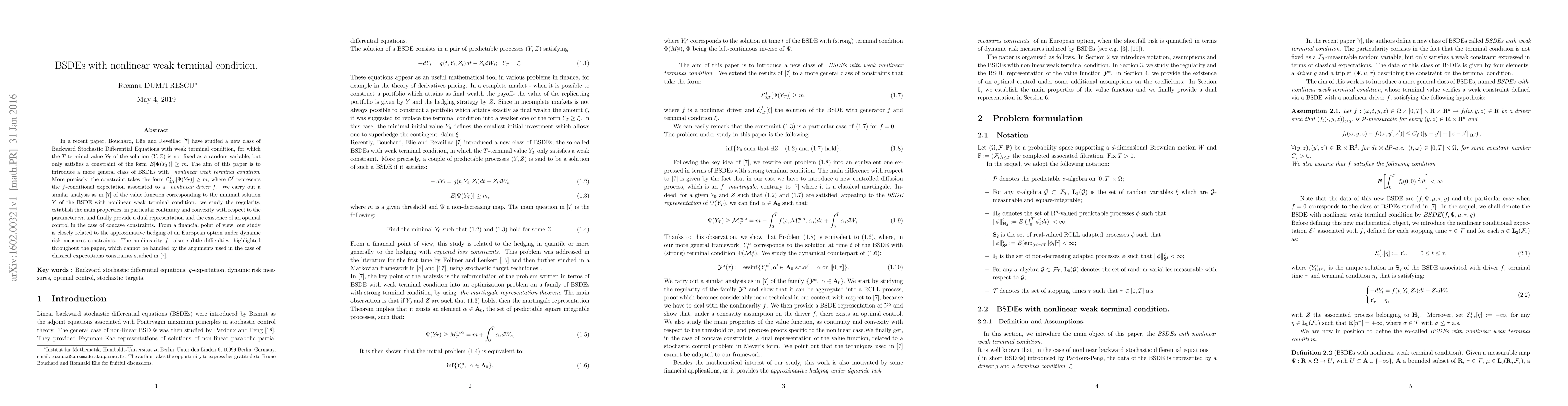

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNonlinear BSDEs with two optional Doob's class barriers satisfying weak Mokobodzki's condition and extended Dynkin games

Tomasz Klimsiak, Maurycy Rzymowski

| Title | Authors | Year | Actions |

|---|

Comments (0)