Summary

This paper is concerned with existence and uniqueness of M-solutions of backward stochastic Volterra integral equations (BSVIEs for short), which Lipschitz coefficients are allowed to be random, which generalize the results in [15]. Then a class of continuous time dynamic dynamic coherent risk measures is derived, allowing the riskless interest rate to be random, which is different from the case in [15].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

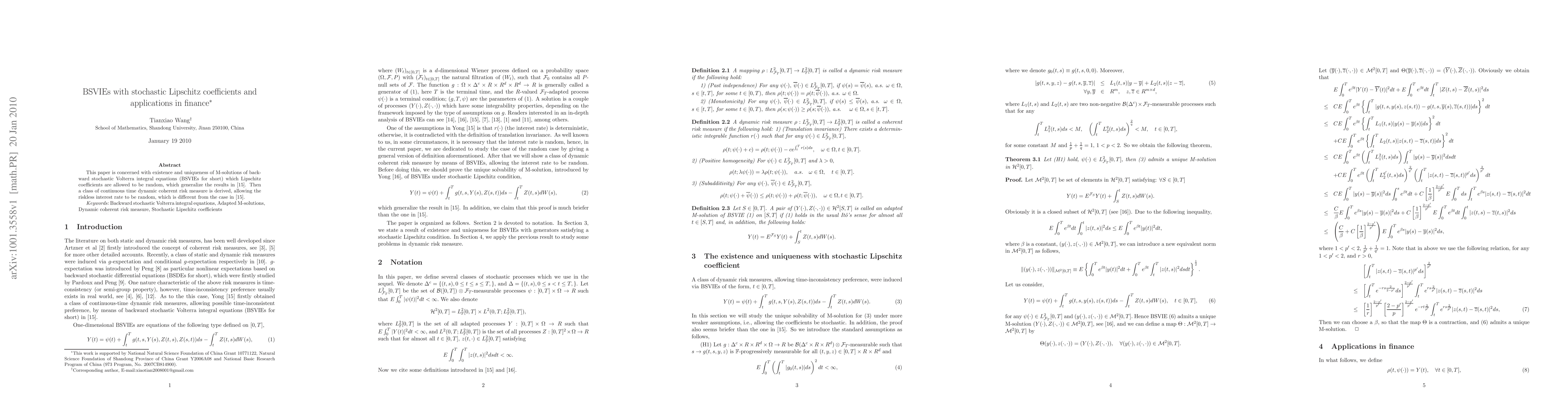

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)