Summary

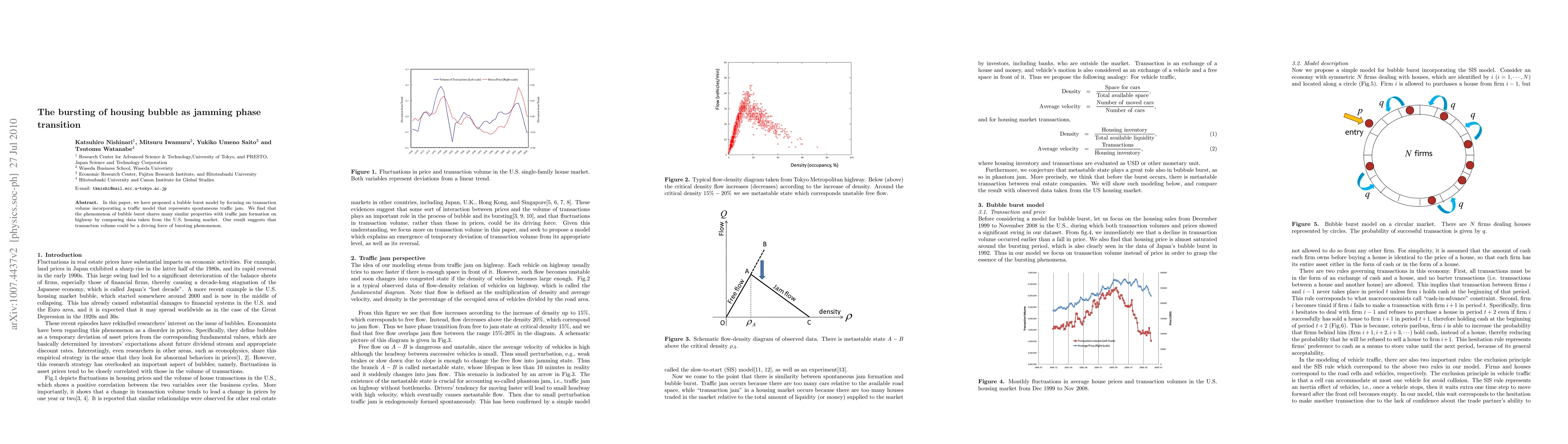

Recently research on bubble and its burst attract much interest of researchers in various field such as economics and physics. Economists have been regarding bubble as a disorder in prices. However, this research strategy has overlooked an importance of the volume of transactions. In this paper, we have proposed a bubble burst model by focusing the transactions incorporating a traffic model that represents spontaneous traffic jam. We find that the phenomenon of bubble burst shares many similar properties with traffic jam formation by comparing data taken from US housing market. Our result suggests that the transaction could be a driving force of bursting phenomenon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)