Summary

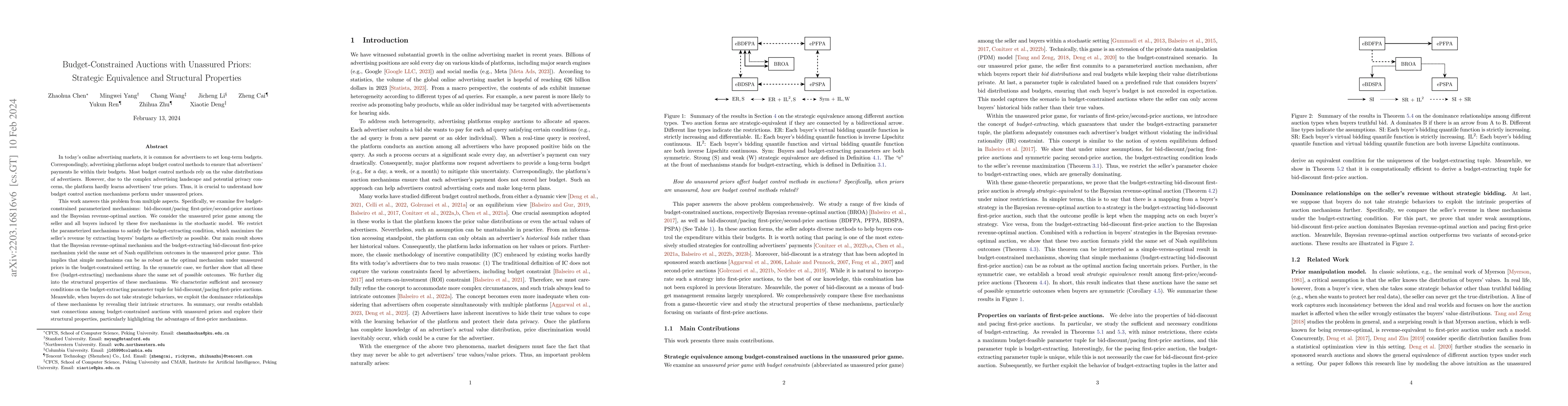

In today's online advertising markets, it is common for advertisers to set long-term budgets. Correspondingly, advertising platforms adopt budget control methods to ensure that advertisers' payments lie within their budgets. Most budget control methods rely on the value distributions of advertisers. However, due to the complex advertising landscape and potential privacy concerns, the platform hardly learns advertisers' true priors. Thus, it is crucial to understand how budget control auction mechanisms perform under unassured priors. This work answers this problem from multiple aspects. We consider the unassured prior game among the seller and all buyers induced by different mechanisms in the stochastic model. We restrict the parameterized mechanisms to satisfy the budget-extracting condition, which maximizes the seller's revenue by extracting buyers' budgets as effectively as possible. Our main result shows that the Bayesian revenue-optimal mechanism and the budget-extracting bid-discount first-price mechanism yield the same set of Nash equilibrium outcomes in the unassured prior game. This implies that simple mechanisms can be as robust as the optimal mechanism under unassured priors in the budget-constrained setting. In the symmetric case, we further show that all these five (budget-extracting) mechanisms share the same set of possible outcomes. We further dig into the structural properties of these mechanisms. We characterize sufficient and necessary conditions on the budget-extracting parameter tuple for bid-discount/pacing first-price auctions. Meanwhile, when buyers do not take strategic behaviors, we exploit the dominance relationships of these mechanisms by revealing their intrinsic structures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)