Summary

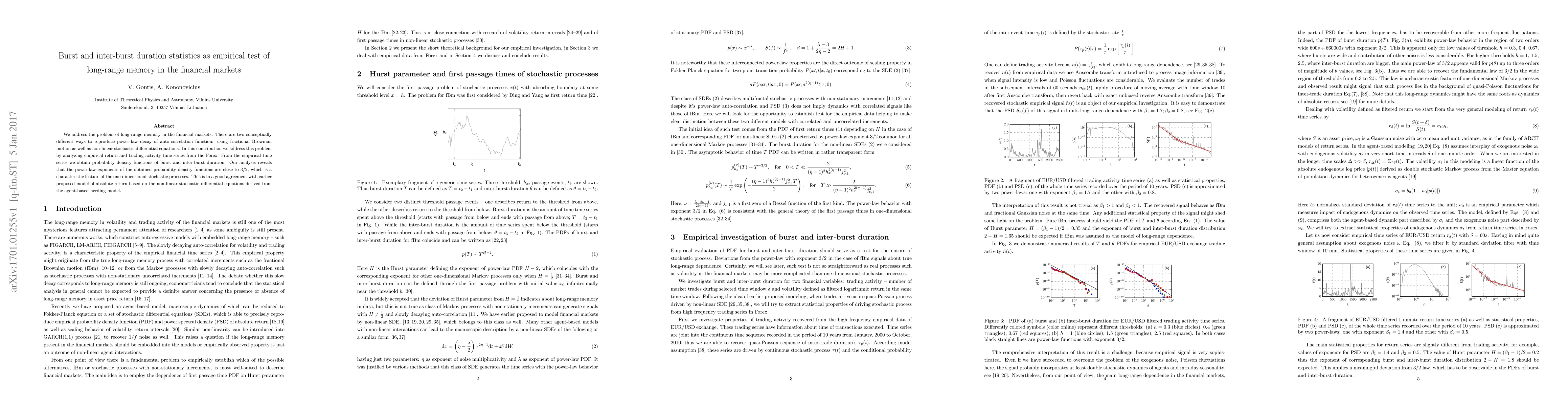

We address the problem of long-range memory in the financial markets. There are two conceptually different ways to reproduce power-law decay of auto-correlation function: using fractional Brownian motion as well as non-linear stochastic differential equations. In this contribution we address this problem by analyzing empirical return and trading activity time series from the Forex. From the empirical time series we obtain probability density functions of burst and inter-burst duration. Our analysis reveals that the power-law exponents of the obtained probability density functions are close to $3/2$, which is a characteristic feature of the one-dimensional stochastic processes. This is in a good agreement with earlier proposed model of absolute return based on the non-linear stochastic differential equations derived from the agent-based herding model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)