Summary

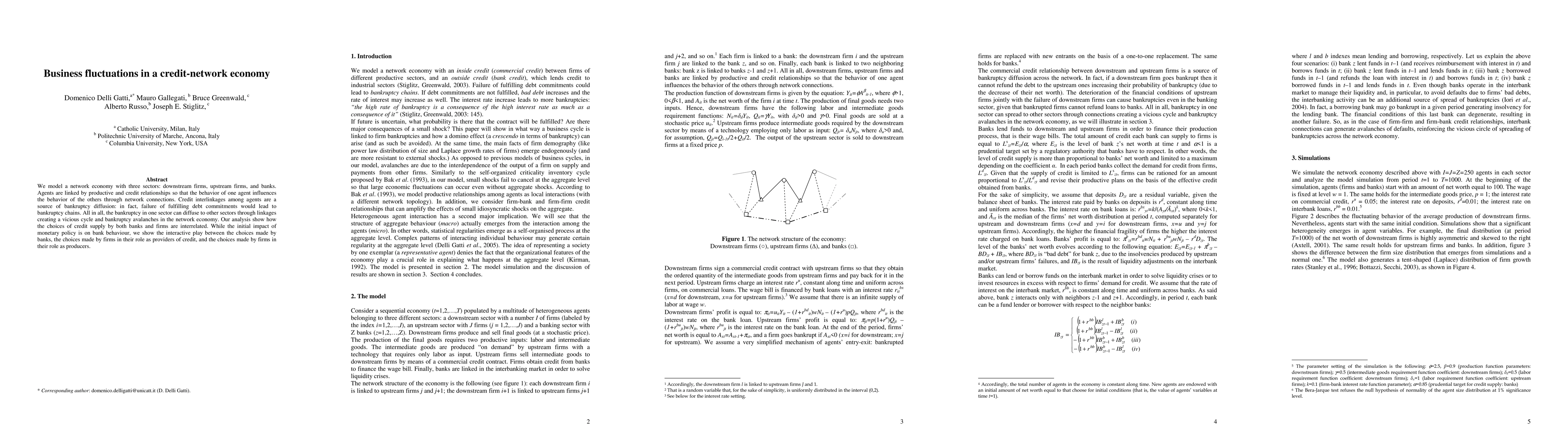

We model a network economy with three sectors: downstream firms, upstream firms, and banks. Agents are linked by productive and credit relationships so that the behavior of one agent influences the behavior of the others through network connections. Credit interlinkages among agents are a source of bankruptcy diffusion: in fact, failure of fulfilling debt commitments would lead to bankruptcy chains. All in all, the bankruptcy in one sector can diffuse to other sectors through linkages creating a vicious cycle and bankruptcy avalanches in the network economy. Our analysis show how the choices of credit supply by both banks and firms are interrelated. While the initial impact of monetary policy is on bank behaviour, we show the interactive play between the choices made by banks, the choices made by firms in their role as providers of credit, and the choices made by firms in their role as producers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlmost Periodically Correlated Time Series in Business Fluctuations Analysis

Lukasz Lenart, Mateusz Pipien

| Title | Authors | Year | Actions |

|---|

Comments (0)