Summary

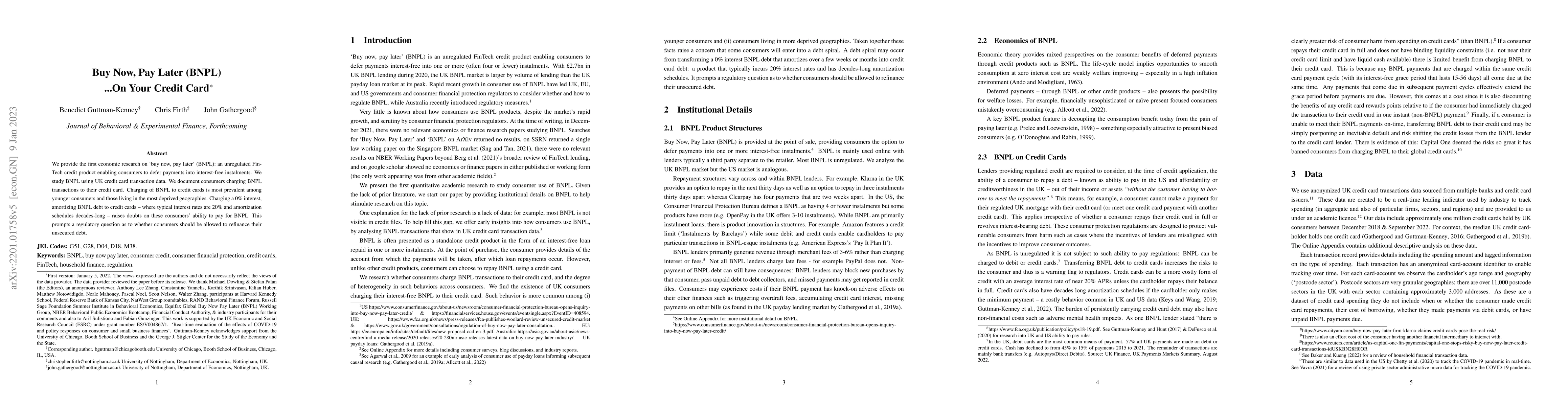

We provide the first economic research on `buy now, pay later' (BNPL): an unregulated FinTech credit product enabling consumers to defer payments into interest-free instalments. We study BNPL using UK credit card transaction data. We document consumers charging BNPL transactions to their credit card. Charging of BNPL to credit cards is most prevalent among younger consumers and those living in the most deprived geographies. Charging a $0\%$ interest, amortizing BNPL debt to credit cards - where typical interest rates are $20\%$ and amortization schedules decades-long - raises doubts on these consumers' ability to pay for BNPL. This prompts a regulatory question as to whether consumers should be allowed to refinance their unsecured debt.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWeighing Anchor on Credit Card Debt

Benedict Guttman-Kenney, Jesse Leary, Neil Stewart

| Title | Authors | Year | Actions |

|---|

Comments (0)