Summary

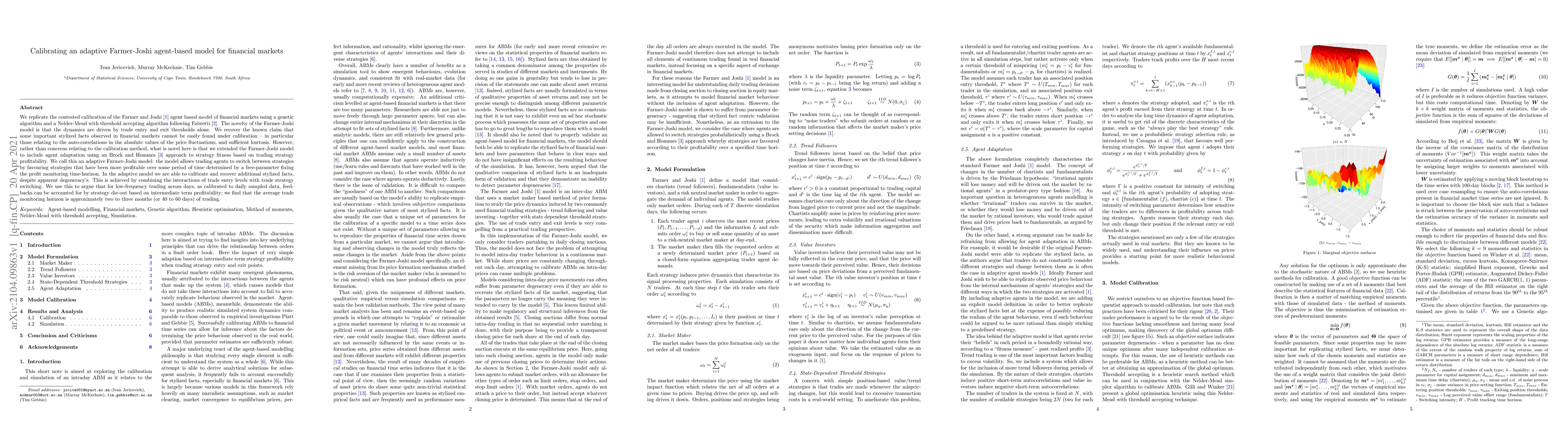

We replicate the contested calibration of the Farmer and Joshi agent based model of financial markets using a genetic algorithm and a Nelder-Mead with threshold accepting algorithm following Fabretti. The novelty of the Farmer-Joshi model is that the dynamics are driven by trade entry and exit thresholds alone. We recover the known claim that some important stylized facts observed in financial markets cannot be easily found under calibration -- in particular those relating to the auto-correlations in the absolute values of the price fluctuations, and sufficient kurtosis. However, rather than concerns relating to the calibration method, what is novel here is that we extended the Farmer-Joshi model to include agent adaptation using an Brock and Hommes approach to strategy fitness based on trading strategy profitability. We call this an adaptive Farmer-Joshi model: the model allows trading agents to switch between strategies by favouring strategies that have been more profitable over some period of time determined by a free-parameter fixing the profit monitoring time-horizon. In the adaptive model we are able to calibrate and recover additional stylized facts, despite apparent degeneracy's. This is achieved by combining the interactions of trade entry levels with trade strategy switching. We use this to argue that for low-frequency trading across days, as calibrated to daily sampled data, feed-backs can be accounted for by strategy die-out based on intermediate term profitability; we find that the average trade monitoring horizon is approximately two to three months (or 40 to 60 days) of trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive Agents and Data Quality in Agent-Based Financial Markets

Ethan Ratliff-Crain, Colin M. Van Oort, Brian F. Tivnan et al.

No citations found for this paper.

Comments (0)