Summary

Binary classification is highly used in credit scoring in the estimation of probability of default. The validation of such predictive models is based both on rank ability, and also on calibration (i.e. how accurately the probabilities output by the model map to the observed probabilities). In this study we cover the current best practices regarding calibration for binary classification, and explore how different approaches yield different results on real world credit scoring data. The limitations of evaluating credit scoring models using only rank ability metrics are explored. A benchmark is run on 18 real world datasets, and results compared. The calibration techniques used are Platt Scaling and Isotonic Regression. Also, different machine learning models are used: Logistic Regression, Random Forest Classifiers, and Gradient Boosting Classifiers. Results show that when the dataset is treated as a time series, the use of re-calibration with Isotonic Regression is able to improve the long term calibration better than the alternative methods. Using re-calibration, the non-parametric models are able to outperform the Logistic Regression on Brier Score Loss.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

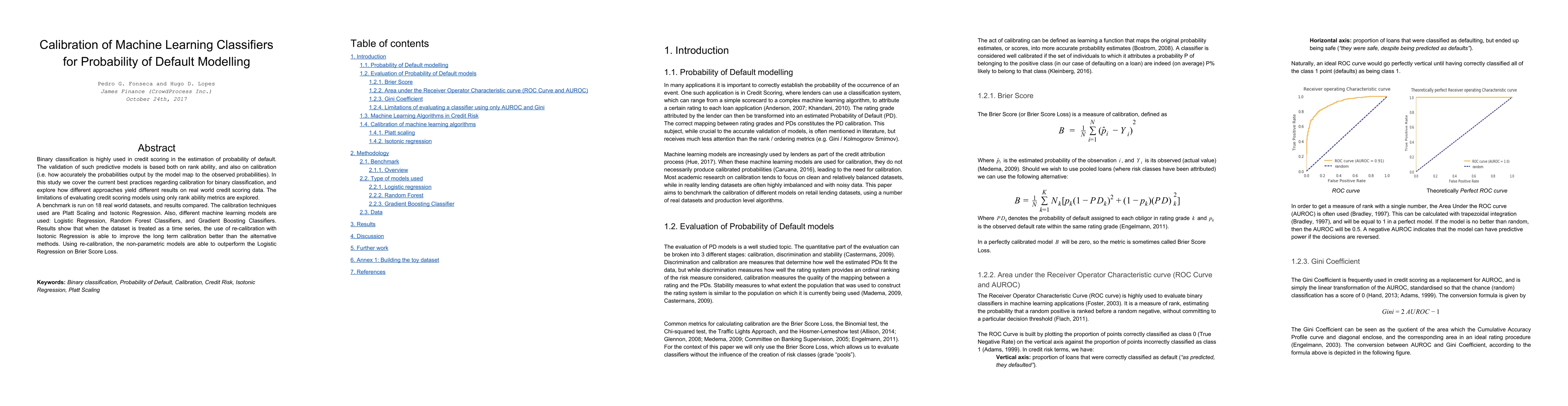

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariable-Based Calibration for Machine Learning Classifiers

Markelle Kelly, Padhraic Smyth

Risk-based Calibration for Probabilistic Classifiers

Aritz Pérez, Carlos Echegoyen, Guzmán Santafé

| Title | Authors | Year | Actions |

|---|

Comments (0)